Top insurance Agency News

-

Understanding Flood Zones A and AE in Houston: Key Differences Explained

Is Flood Zone A more dangerous than Zone AE in Houston? If you are buying or owning property in Houston and see Flood Zone A or Flood Zone AE listed, it is easy to assume they are identical. They are…

-

Why Is Flood Insurance So Expensive in Flood Zone AE?

Watch Chris explain this in detail If you live in Flood Zone AE and your mortgage payment just went up $200 to $400 per month, your flood insurance is likely the reason. Zone AE flood insurance commonly ranges from $800…

-

Why Did My Mortgage Payment Go Up? The Real Reason (And Why Flood Insurance Is Usually the Lever)

Watch Chris explain this in detail [Embed Video #1 Here]Companion Video: “Why Did My Mortgage Payment Go Up $300? (It’s Your Flood Insurance)”Watch Chris explain this in detail. Why Did My Insurance Double? Did your mortgage just jump $100… $200……

-

Understanding Fairfield Flood Insurance: Why $1,000 Deductibles Are Best

Should you raise your flood insurance deductible to save money in Fairfield?Or could that decision cost you thousands more when the next storm surge hits? If you own a home along the Fairfield coast, deductible choice is not just a…

-

My Flood Insurance Went Up 18%: Whats Happening and What Can I Do?

Watch Chris explain this in detail If your flood insurance renewal increased exactly 18%, it wasn’t random. It wasn’t a typo. And it wasn’t your agent making a mistake. 18% is the maximum annual increase allowed under FEMA’s Risk Rating…

-

Flood Insurance in Houston Zone X: Costs, Comparisons, and Considerations

If your Houston home is in Flood Zone X, do you really need flood insurance? Zone X is often described as low risk and optional for flood insurance. That is technically true for most mortgages. However, in Houston, optional does…

-

1968 Volkswagen Dune Buggy – Zehr Insurance Brokers Ltd.

Built by Ethan Purcell This month’s feature is a 1968 Volkswagen Dune Buggy built almost entirely from reclaimed and rediscovered parts. It is proof that craftsmanship and persistence can turn scrap into a standout. The chassis was pulled from a…

-

NFIP Flood Insurance in Houston: Real Costs and Coverage Insights

How much does NFIP flood insurance really cost in Houston in 2026?And when is NFIP actually the better option compared to private flood insurance? If you own a home in Houston, flood insurance is a financial decision that can cost anywhere…

-

5 Key Factors Affecting Flood Insurance Costs in Jacksonville

Seeing Flood Zone AE on a Jacksonville flood map can feel like an instant deal breaker.Does it automatically mean high flood insurance costs and closing delays? Flood Zone AE often gets the blame, but it is rarely the real problem….

-

Private Flood Insurance in 2026: Real Data and Savings Revealed

If you currently pay flood insurance, there is a good chance you feel uneasy. NFIP premiums keep rising, renewal notices feel unpredictable, and many homeowners are left wondering if private flood insurance is a legitimate alternative or a risky shortcut….

-

NFIP vs Private Flood Insurance in Houston: 2026 Cost Comparison

Is private flood insurance actually cheaper than NFIP in Houston?Or does the answer depend on your flood zone, ZIP code, and even your street? If you are buying flood insurance in Houston, you have probably heard that private flood insurance…

-

How Financial Statements Strengthen Your Surety Bond Capacity – Zehr Insurance Brokers Ltd.

BBA, CAIB, President, Zehr Insurance Your Financial Story Matters As a contractor working to expand your business, your financial statements do far more than satisfy your accountant or lender — they tell the story of your company’s ability to take…

-

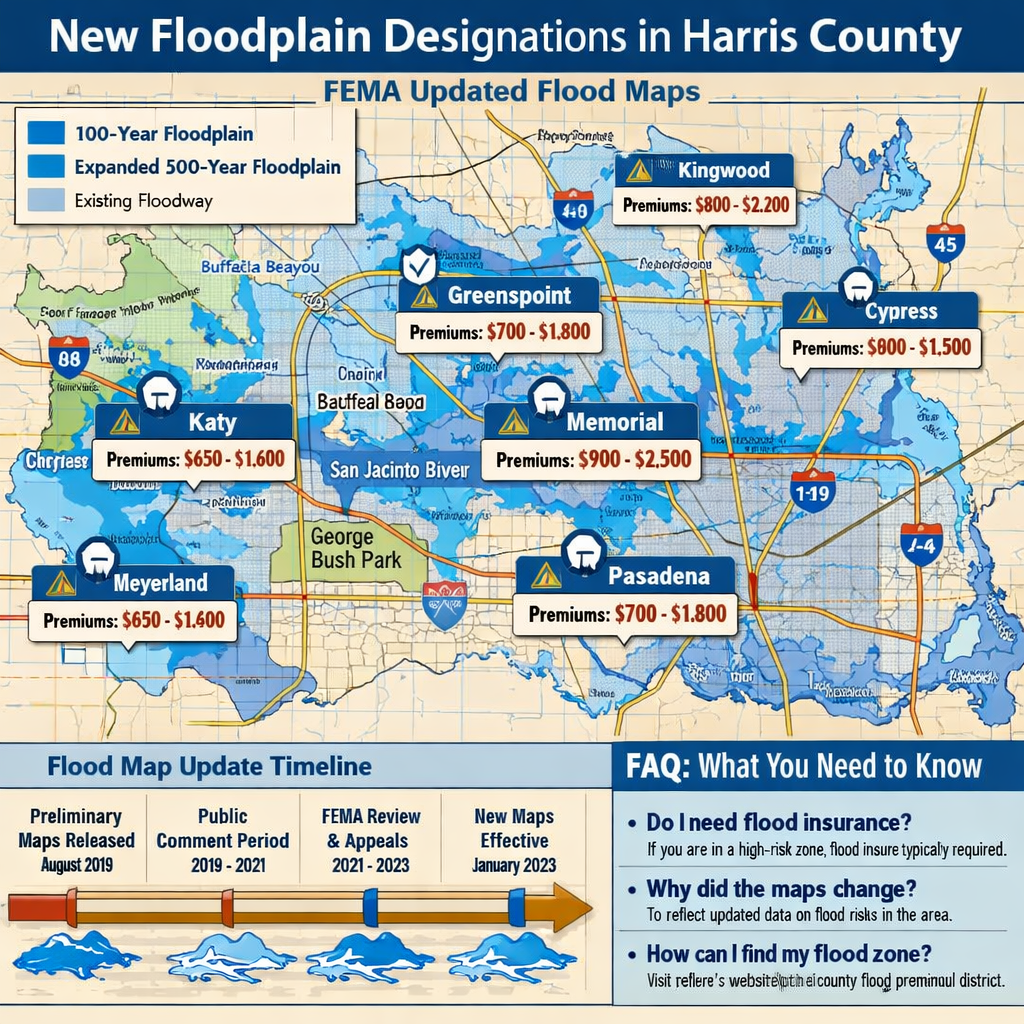

Impact of New Flood Maps on Houston Homeowners and Insurance Rates

Floodplain Expansion +43% 130 sq. miles added Last Map Update 2007 19 years ago Properties Since Harvey 65,000 built in flood zones New Rainfall Estimate 17″ in 24 hours (was 13″) What Just Happened On February 10, 2026, FEMA quietly…

-

Paid Off Your Mortgage? Why Canceling Flood Insurance Could Be Your Biggest Financial Mistake

Have you recently paid off your mortgage and felt a wave of relief and pride?Are you now wondering if you can start cutting costs, maybe by canceling flood insurance that your lender once required? In this article, you’ll learn the…

-

How to Lower Your Alabama Mortgage Payment by Reducing Flood Insurance Costs

Are your monthly mortgage payments increasing and you are not sure why? For many Alabama homeowners, the answer is hidden inside the escrow account. Rising flood insurance premiums from FEMA are quietly inflating payments month after month. In this article,…

-

How Much Does Flood Insurance Cost in Alabama? Real 2026 Pricing Data

Are you wondering what flood insurance in Alabama actually costs, without the vague “it depends” answers? Frustrated by national averages that don’t apply to your property in Huntsville, Birmingham, or Mobile? You’re not alone. Flood insurance pricing is all over…

-

Connecticut

The real estate landscape in Connecticut is about to change. At The Flood Insurance Guru, we’ve seen firsthand how flood risk has long been hidden behind complex maps and technical language. For years, many investors purchased properties unaware of their…

-

How to Reduce Fairfield Flood Insurance Costs in 2025

You’re paying $3,800 a year for flood insurance on your Fairfield property. That’s more than your property taxes. More than your homeowners insurance. It’s straining your budget and you wonder: “Is there any legal way to reduce this?” You’re not…

-

Houston Flood Insurance Rates in 2026: Why They Keep Rising

If you live in Harris County and recently opened your FEMA renewal letter, you might have felt a sudden wave of financial stress. Many homeowners are seeing repeat increases, often up to 18 percent, and are left wondering why. Flood…

-

How Closing Costs Can Impact Flood Insurance: A Real Estate Investor

Real estate investing is all about numbers: purchase price, rehab budget, and cash flow. But one expense blindsides even seasoned investors, flood insurance buried in closing costs. This oversight has derailed deals, wiped out profits, and forced investors to abandon…

-

How Much Does Flood Insurance Cost in Florida in 2026?

Are you wondering what flood insurance will actually cost you in Florida this year? If so, you’re not alone. Florida leads the nation in flood insurance policies, but most online answers to “how much does flood insurance cost in Florida?”…

-

Flood Insurance Cost 2026: Averages, Benchmarks & How to Save

In 2026, flood insurance pricing is more confusing than ever. Across the country, homeowners are experiencing significant changes in premiums, largely driven by FEMA’s Risk Rating 2.0. For many, the new system feels unclear, unpredictable, and unfair. This guide breaks…

-

Hoover Homeowners: Reduce Flood Insurance Costs by Reclassifying Your Basement as a Walkout

Are You Overpaying for Flood Insurance Because of a Walkout Basement? If you own a home in Hoover, Alabama, especially in neighborhoods like Riverchase, Greystone, or Lake Cyrus, a finished basement is a huge value add. It might be your…

-

Navigating Flood Insurance Challenges for Jacksonville Homeowners

Why do flood insurance costs seem to change at the worst possible moment, often right before closing? If you are buying or owning a home in Jacksonville, you are likely seeing it firsthand. Flood insurance premiums that jump without warning,…

-

Understanding Flood Zone AE in Jacksonville: What Really Impacts Your Insurance

If you are a Jacksonville homeowner or buyer, seeing Flood Zone AE on a flood map or lender document can feel overwhelming. Insurance quotes jump, timelines tighten, and suddenly everyone has a different opinion about what Flood Zone AE really…

-

How Flood Insurance Made Your Birmingham Mortgage Jump $300+

Did your mortgage payment suddenly jump by $200 to $300 a month without warning? You are not imagining it. This issue is hitting homeowners across Birmingham, especially in flood-prone ZIP codes like 35211, 35124, and areas near Valley Creek. The…

-

Huntsville Commercial Flood Insurance Inventory Converse Gaps Explained

Does Commercial Flood Insurance Cover Inventory in Huntsville? Yes, but there are strict limits. Standard FEMA (NFIP) commercial flood policies cap Business Personal Property (inventory) coverage at $500,000. For businesses with higher inventory values, a Private Commercial Flood Policy is…

-

1941 International KB-5 – Zehr Insurance Brokers Ltd.

Alessandro’s 1941 International KB-5 This month we are featuring a one-of-a-kind 1941 International KB-5 custom rat rod. The project began in 2021 when the owner spotted the truck on the side of the road while heading to a swap meet….

-

How One $650 Document Could Save Alabama Homeowners Over $75,000 in Flood Insurance

If you’re paying more than $1,000 a year for flood insurance in Alabama, there’s a good chance you’re overpaying, and you’re not alone. Thousands of homeowners are unknowingly spending far more than they should because they’ve never been told about…

-

Pelham Flood Insurance: Why You

Are you paying $600 more than your neighbor for flood insurance and not even know it? In Pelham, Alabama, two homes on the same street can have drastically different premiums, even with identical coverage. The reason? Most homeowners aren’t shopping their…

-

2026 CT Flood Insurance: Navigating Rising Rates and New Maps

Have you opened your 2026 flood insurance renewal and felt a pit in your stomach?Are you unsure whether your new rate is fair or if you’re being overcharged without realizing it? For Connecticut homeowners, especially in coastal or inland flood-prone…

-

Ensure Your Flood Insurance Policy Meets Lender Requirements

Will My Bank Accept My Flood Insurance Policy? You bought flood insurance to protect your home, but will your lender accept it?What if your policy gets rejected right before closing, costing you time, money, or worse, the deal itself? This happens…

-

Why Flood Insurance in Anniston Costs Too Much, And How to Fix It

If you live in Anniston or Oxford, you know the challenge of being in the “Valley.” You check your mortgage and see a steep flood insurance charge. The FEMA map says Zone AE, thanks to runoff from Cheaha Mountain or…

-

Flood Insurance Costs: Fairfield vs. Old Saybrook, Who Pays More?

Whether you’re eyeing a beachside cottage in Old Saybrook or a luxury home in Fairfield, many buyers in Connecticut are shocked to see flood premiums over $3,000 per year, often with little explanation. The good news is that you have…

-

Why Standard Flood Insurance Isnt Enough in High-Risk Zones

Flood insurance is required for most homeowners in high-risk areas, but standard coverage through the National Flood Insurance Program (NFIP) may give you a false sense of security. While it offers building coverage up to $250,000 and contents coverage up to…

-

Surety Bonds vs. Letters of Credit – Zehr Insurance Brokers Ltd.

BBA, CAIB, President, Zehr Insurance Why Project Owners and Contractors Prefer Bonds When project owners require financial security from a contractor, two instruments are often discussed: surety bonds and letters of credit (LOCs). While both are designed to protect the…

-

Understanding the Private Flood Insurance Clause for Home Loans

/ Private Flood Insurance Clause Private Flood Insurance Clause Explained: What Homeowners and Buyers Need to Know By Chris Greene | 4 min read If you’re buying or refinancing a home in a flood zone, you’ve probably heard your lender…

-

The Hidden Financial Risks for CT Landlords: Why NFIP Falls Short

What happens when your rental floods and the rent checks stop coming? If you’re a Connecticut landlord with flood insurance through FEMA’s National Flood Insurance Program (NFIP), you might think you’re covered. But what most landlords don’t realize is that…

-

Do I Have to Use FEMA for Flood Insurance in Decatur? (How to Save Hundreds)

If you just opened a letter from your mortgage company saying you need flood insurance in Decatur, Florence, or Muscle Shoals, and you’re staring at a potential $3,000 FEMA quote, you’re not alone. In this article, you’ll learn how to…

-

Is an Elevation Certificate Worth the Cost in Houston? (The 2026 Math)

Could FEMA be overcharging you based on inaccurate elevation data? If you’re a homeowner in Houston, you might be paying a flood insurance premium based on a number that doesn’t match your home’s actual height above ground. Since FEMA updated…

-

Why Does Flood Insurance in Old Saybrook Cost $3,931? (And How to Fix It)

Why are Old Saybrook homeowners getting flood insurance quotes that are nearly 50% higher than the state average? Why does FEMA say your policy is “correct” even when it feels completely broken? If your renewal bill just hit your inbox…

-

Top Strategies to Reduce Flood Insurance Costs for Huntsville Apartments

Are you tired of paying too much for flood insurance on your apartment complex? Do you feel like your premiums are just a fixed cost you have no control over? You’re not alone. Flood insurance is one of the most…

-

Canceling Flood Insurance Mid-Term in 2026: What You Need to Know

Can you cancel your FEMA flood policy mid-term to switch to private insurance? You’ve probably been there, your FEMA flood insurance renewal shows up, and to avoid a lapse, you pay it. Then, a week later, you find out a…

-

Best Private Flood Insurance in Houston: 2026 Review

Can you really trust Titan, Argenia, or TFIA with your home’s flood protection? If you live in Houston and just got a flood insurance quote with a name you don’t recognize, Titan, Argenia, or TFIA, you’re probably asking: Who are…

-

Poison IVY – Zehr Insurance Brokers Ltd.

Owned by Mario and Kendra of Calleja Kustoms Mario and Kendra spent seventeen years building their vision. Poison IVY is the embodiment of a dream to build an early ’60s show car in the classic style of Big Daddy Ross,…

-

Planning For The Future: Succession Planning – Zehr Insurance Brokers Ltd.

Posted On December 15, 2025 Written by Dave Stewart Zehr Insurance Brokers Ltd. A farm is more than just land, equipment, and livestock, it’s a legacy built through generations of hard work and dedication. But without a clear plan,…

-

Houston Zone AE Flood Risk: Why Katy and The Woodlands Face Different Dangers

Why do AE homeowners need flood insurance while their neighbors in Zone X think they don’t? Have you ever struggled to explain to a neighbor why you pay for flood insurance and they don’t? Maybe they said, “I’m not near…

-

1956 Mercedes-Benz 300SL Gullwing A Canadian Time Capsule – Zehr Insurance Brokers Ltd.

Owned by Dr. Hassan Moghadam – Ottawa, QC Some vehicles stop you in your tracks. The 1956 Mercedes-Benz 300SL Gullwing owned by Ottawa surgeon Dr. Hassan Moghadam is one of those cars. Known worldwide for its performance and unmistakable doors,…

-

Preparing Your Farm for Winter: A Practical Guide for Ontario Farmers – Zehr Insurance Brokers Ltd.

Your Winter Prep Checklist Livestock Care Ensure barns and shelters are insulated, dry, and well-ventilated. Check water systems to prevent freezing and stock up on bedding to keep animals warm. Monitor feed quality and adjust rations — livestock often need…

-

1991 Acura NSX – Zehr Insurance Brokers Ltd.

Owned by Justin Sookraj, OBLIVION 80s & 90s Car and Culture Showy Adam, Oshawa – ON Developed with direct input from Honda’s F1 program and legendary driver Ayrton Senna, the Acura NSX was the ultimate expression of Honda’s engineering in…

-

Cyber Security: What to look for and avoid – Zehr Insurance Brokers Ltd.

Posted On October 15, 2025 Written by Dave Stewart Zehr Insurance Brokers Ltd. Farming isn’t just about dirt on your hands, it’s also about data at your fingertips. From GPS-guided tractors to online banking, modern farms run on technology….