Complete Guide to Filing Flood Insurance Claims in Atlanta, GA

Have you ever found yourself wading through the aftermath of a flood in Atlanta, feeling uncertain about how to salvage your home and belongings? This guide will walk Atlanta homeowners through every step required to file a flood insurance claim, from understanding your insurance policy to documenting damage and maximizing your claim.

I’ll draw on my personal experience with Georgia floods and my proficiency in flood mitigation to assist you in overcoming the challenges of flood recovery. We’ll address the critical distinctions between flood and homeowners insurance claims in Georgia, ensuring you’re equipped to navigate this process with certainty.

By diving into this content, you’ll equip yourself with invaluable knowledge that aims to transform a difficult situation into a manageable recovery journey, keeping your property—and peace of mind—afloat. understanding flood insurance costs in Georgia

Understanding Flood Insurance in Atlanta, GA

Living in Atlanta, GA, where the skies can open up in a heartbeat and hail or water can rise rapidly, understanding the nuances of flood insurance is crucial for homeowners. I’ve seen the aftermath of flooding, and I can assure you the distinctions between standard home insurance and a policy through the National Flood Insurance Program, backed by the Federal Emergency Management Agency, are significant. In this guide, we’ll navigate the crucial coverages for your home, including structural protection, safeguarding personal belongings, and ensuring additional living expenses are met. Each aspect is critical in securing your financial peace of mind in flood-prone areas. Make sure to understand your insurance policy for complete coverage.

The Importance of Flood Coverage in Flood-Prone Areas

During the storm season in Atlanta, the likelihood of water damage striking a home can be dauntingly high. From my experiences with the 2009 Atlanta and 1990 Augusta flooding, I’ve learned that comprehensive flood coverage stands between a devastating loss and a manageable recovery process. Flood insurance plays a pivotal role in flood control, offering critical financial protection separate from standard homeowner policies, which typically do not cover flood-related damage. Flood insurance plays a pivotal role in flood control, offering critical financial protection separate from standard homeowner policies, which typically do not cover flood-related damage.

As one who has personally witnessed the devastating impact of floods, I cannot emphasize enough the importance of securing a robust flood insurance policy. Consulting with a lawyer skilled in property insurance law or a professional specializing in life insurance can highlight the complexities flood damage claims may entail. With Atlanta‘s propensity for sudden storms, having adequate coverage is not just a safeguard – it is a strategic move to protect life and property.

Differences Between Standard and Special Flood Hazard Areas

When it comes to flood insurance in Georgia, it’s crucial to recognize the differences between Standard Flood Hazard Areas (SFHAs) and areas outside of them. Homeowners like us residing within SFHAs in Atlanta often encounter stricter building regulations and may be mandated to purchase flood insurance if we have mortgages from federally regulated lenders. Our policies must consider the heightened risk of heavy rain and faster accumulation of water, which can lead to more substantial claims from property insurance holders.

On the other hand, properties located outside of these high-risk zones aren’t typically required to carry a flood insurance policy. However, as I’ve personally observed, it’s an intelligent decision to consider protection beyond the minimum given Atlanta‘s unpredictable weather patterns. Securing flood insurance voluntarily can save homeowners from the financial ruin rain-induced flooding could cause, even if their property lies outside ‘official’ flood plains. Here’s a snapshot of how these areas differ in terms of policy recommendations and requirements:

|

Area Type |

Flood Insurance Requirement |

Reason |

|---|---|---|

|

Standard Flood Hazard Area (SFHA) |

Often Required |

High risk of flooding due to location |

|

Non-SFHA |

Not Required (but recommended) |

Lower risk, yet unpredictable weather patterns |

How Flood Insurance Works in Georgia

As an Atlanta homeowner, I found that navigating flood insurance can be akin to mapping out a floodplain: essential and intricate. In Georgia, flood insurance is typically purchased through the National Flood Insurance Program (NFIP), which falls under the stewardship of the Federal Emergency Management Agency (FEMA). This program is designed to mitigate the financial risk to homeowners living within and outside of established floodplain areas. Unlike standard liability insurance, which doesn’t ordinarily cover flood-related damages, policies obtained via NFIP provide the necessary protections against losses from overflow of inland waters, rapid accumulation, and runoff of surface waters, including the oft-overlooked peril from sewage backups.

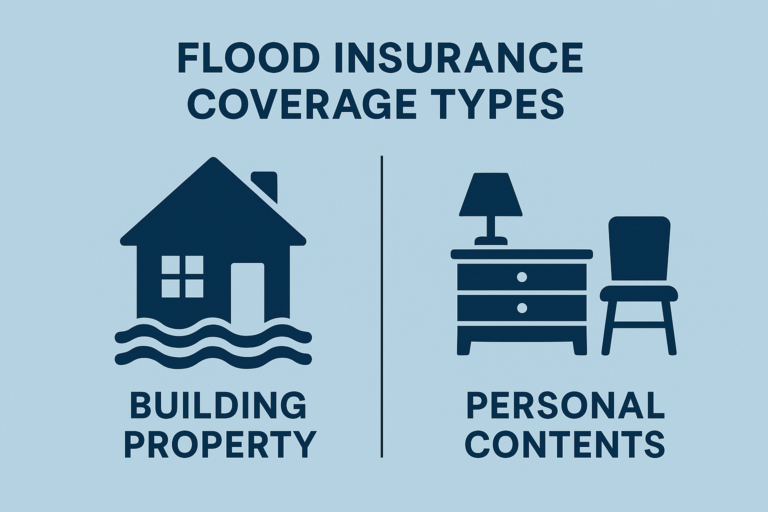

Understanding this coverage was crucial when torrential rains left my neighborhood awash and many questioning their readiness. Flood insurance policies in Georgia are built on the foundation that recognizes the unique needs of homeowners—whether they dwell on a historic floodplain or in seemingly safer zones. Essential to emergency management planning, these policies often incorporate coverage that addresses both the structure and its contents, thus providing a more comprehensive financial safety net against the unpredictability of nature’s waterworks.

Here’s a critical comparison between the NFIP and typical homeowner’s liability insurance:

|

Insurance Type |

Coverage for Flood Damage? |

Typical Coverage Areas |

|---|---|---|

|

National Flood Insurance Program (NFIP) |

Yes |

Structure and Contents |

|

Homeowner’s Liability Insurance |

No |

Non-flood Disasters, Personal Property, Liability |

Building Coverage for Your Atlanta Georgia Home

In my experience, having an accurate understanding of building coverage for your home in Metro Atlanta is instrumental when dealing with flood insurance claims. This part of your policy often covers physical structures like the roof and foundation, including vital systems such as plumbing and electrical wiring. As a homeowner with a mortgage, it’s paramount that you verify that your building coverage is sufficient to rebuild or repair key aspects of your home, especially the basement, where floods can wreak havoc. For more insights on this, learning if my basement flooded will insurance cover it can be highly beneficial.

I recall a time when a neighbor’s residence sustained flood damage, and their quick action in evaluating the structural integrity immediately after the event was crucial. They were able to file a well-documented claim, ensuring their home’s stability from the rooftop down to the base. Learning from such scenarios, in the heart of Metro Atlanta, I advise taking proactive measures, like regularly inspecting and maintaining crucial systems and parts of your property, to safeguard against potential flood-related financial losses.

Personal Belongings Coverage

In the face of severe weather, homeowners need to understand that flood insurance extends beyond the structural confines; personal belongings coverage is also a key component. Having faced the wrath of floodwaters myself, I know firsthand the importance of protecting items within my home. This element of flood insurance encompasses furniture, clothing, and other personal effects that can be lost to the deluge caused by river overflow – a fact underscored by data from the National Oceanic and Atmospheric Administration showing the increasing frequency of such events.

In those critical moments following flood damage, knowing which pieces of information would be necessary for a personal injury claim provided solace. Alongside recording the damages, I advise you to keep an inventory and photographic evidence of valuables, ensuring efficient processing of your flood insurance claims. As an Atlanta resident accustomed to the ebb and flow of our local waterways, I’ve learned that including detailed information about your cherished assets is pivotal in securing adequate compensation.

Additional Living Expense Coverage

When I weathered the surge of storms in Atlanta, managing the added expenses during home repairs was seamless, thanks to the Additional Living Expense (ALE) coverage included in my flood insurance. This provision was essential for covering the costs of temporary housing, meals, and other necessities when my home was uninhabitable. Securing a flood insurance quote that factors in ALE can fortify your financial footing against the unpredictable onslaught of heavy rain and snowmelt that too often overwhelms dams and leads to floods.

It’s the assistance received for living expenses, while my home was being restored, that truly emphasized the value of thorough flood coverage. I have witnessed neighbors grappling with the chaos of displacement, unaware that their policies could extend to such crucial aid. It’s worth consulting with knowledgeable lawyers specializing in property and flood insurance law to comprehend the scope of ALE coverage, ensuring that during periods of recovery, the focus remains on rebuilding without the burden of unmanageable out-of-pocket costs.

Preparing Before a Flood Occurs

As homeowners in Atlanta, it’s imperative that we proactively prepare for flood events and potential flood damage. Documenting our property and valuables thoroughly, reviewing the intricate details of our flood insurance policies, and implementing emergency measures are crucial steps to safeguard our investments. I’ll share how engaging with insurance companies and attorneys in this process can offer additional layers of security. These preemptive actions ensure that when we approach our insurance company with a claim, we have all the requisite information at hand, paving the way for a smoother recovery experience.

Documenting Your Property and Valuables

Before any flood risk, cataloging each item in your Atlanta home is paramount to streamline your insurance claim afterward. Speaking from experience, I recommend using a video tour to document your belongings, supplementing this with receipts and appraisals, especially for high-value items. This thorough inventory ensures that should the unfortunate event of flooding occur, the evidence of your possessions is unequivocal, aiding in an accurate assessment of damages and easing potential disputes over claim amounts.

Understanding the intricacies of the applicable deductible on your policy and its impact on your claim, down to the nuances of the flood insurance rate map, is a responsibility I take seriously. Ensuring these details are in place and familiarizing yourself with them means you’re better positioned to navigate the aftermath of a flood. With this preparation, dealing with the aftermath became more about efficient recovery rather than untangling complexities with the insurance or loan company, ultimately minimizing the financial strain that damages could enforce on your home and life.

Reviewing Your Flood Insurance Policy Details

As an Atlantan who’s lived through floods resulting from sudden squalls and wind storms, I’ve learned the vitality of reviewing your flood insurance policy thoroughly. Ensuring you’re aware of their distinct terms, especially if you’re in an area impacted by factors like elevation and drainage, is critical. Regularly re-assessing your coverage ensures that you’re prepared for any natural disaster, not just the flood damage we often associate with bad weather in Atlanta, GA.

After experiencing tornado aftermaths and hearing countless stories of wind exacerbating flood conditions, my mantra is simple: know what you’re covered for and what you aren’t. I can’t stress enough the importance of understanding the details of your flood insurance policy, from what’s considered ‘covered damage’ to how claims are assessed post-disaster. This knowledge is your first line of defense when facing the financial impact of natural catastrophes.

Emergency Measures to Protect Your Home

As someone who’s lived through the ravages of flash floods in Atlanta, taking preemptive steps such as installing sump pumps and applying sealants can thwart water from wreaking havoc on your home’s integrity and stave off mold growth. When skies darken, and lightning signals the approach of a storm, fast-acting measures like using sandbags or flood barriers become critical defense tactics, reducing the hazard that floodwaters present to your living space and giving you peace of mind that you’ve done your part to mitigate potential damage. Georgia flood insurance Atlanta

What I’ve learned from my firsthand experiences is that during times of potential flooding, keeping a vigilant eye on water levels and staying informed of a storm‘s progression is essential. It’s wise to create an emergency kit, fortified with essentials like batteries and first aid supplies, to hold out until the peril subsides or evacuation is necessary. Remember, the fee for being unprepared can be significant; emotionally, monetarily, and in terms of the safety of your loved ones, taking preemptive protective action is invaluable.

Immediate Actions After a Flood

As the flood waters recede, immediate steps are integral to begin the path to recovery for your Atlanta home. Prioritize safety by meticulously inspecting potential hazards, such as damaged pipes, before re-entering your residence. Promptly contacting your insurance agent is crucial, ensuring adherence to the National Flood Insurance Act of 1968. Amid these priority actions, initiate the cleanup process thoughtfully to prevent further damage. As a veteran of similar ordeals, I understand the need for urgency balanced with management of safety risks. We’ll tackle these pivotal actions, addressing concerns like bad faith on the part of insurers and safeguarding damaged valuables from a faulty washing machine to priceless heirlooms.

Related Article – After a flood

Ensuring Safety Before Returning Home

In the aftermath of a flood like Hurricane Helene, our immediate focus is safety. Before stepping foot back into your Atlanta home, it is crucial to have a professional conduct a thorough inspection for potential construction weaknesses and threats of fire from damaged electrical systems. As your Flood Insurance Guru, I can’t stress enough the importance of ensuring that the structure is sound, utilities are operational, and emergency services have deemed the area safe.

Even something as innocuous as a backed-up toilet can signal deeper plumbing issues, so engaging with experts to check sump pumps and sewage lines is a step you shouldn’t skip. Drawing from my encounters with Georgia floods, quick intervention can prevent further harm and facilitate a smoother transition back to normalcy. Prioritize communication with your insurance agent and document all damage – keeping these records will be vital:

|

Damage Type |

Response |

Documentation Needed |

|---|---|---|

|

Structural |

Engage construction professional |

Inspection report |

|

Electrical |

Contact utility company |

Repair records |

|

Plumbing |

Hire a licensed plumber |

Service and repair invoice |

The initial return to a flood-affected dwelling is not just about assessing damage; it’s an opportunity to mitigate additional risks. If you observe water near electrical outlets or smell gas, it’s imperative to take a step back and call emergency services immediately. Remember, hasty re-entry can lead to devastating consequences. Your safety and that of your loved ones must come first.

Contacting Your Insurance Agent Promptly

After a flood, reaching out to your flood insurance agent should top your list of priorities. Their insight into the current market value of properties affected by disaster, the cost of repairs, and the complexities of filing claims, provides you with the guidance needed to navigate this challenging time. Acting promptly ensures that you’re in sync with the emergency alert system and its timelines, so your agent can advocate on your behalf without delay, potentially maximizing your claim outcome. For more detailed guidance, you might find this report a claim page helpful.

I understand from my own experiences that time is of the essence when reporting flood damage to your agent. You are then positioned to receive expert advice on immediate steps and the documentation essential for a successful claim. Quick communication can help curtail further costs associated with your property‘s damage, and your agent’s prompt action can streamline the claims process, minimizing the financial impact of the flood on your home.

Starting the Cleanup Process Safely

Once the floodwater recedes, starting the cleanup process safely is paramount. Having navigated such chaos in Atlanta myself, I recommend engaging with professional clean-up services experienced in flood recovery, as they understand the potential hazards such as hidden structural damage or contaminated water. This step isn’t just about removal; it’s about ensuring the work is done correctly to maintain the structure’s integrity and your family’s health.

Furthermore, I learned that thorough drying of affected areas was paramount in mitigating mold growth and preventing further water damage. Utilizing equipment such as fans and dehumidifiers, as well as opening windows to facilitate air circulation, helped expedite the drying process. By taking these immediate measures, I not only safeguarded the integrity of my home’s structure and interior but also streamlined the process for any future flood insurance claims. These proactive steps proved to be instrumental in minimizing the long-term repercussions of the flood, reinforcing the importance of swift and efficient cleanup efforts in the aftermath of such natural disasters.

Filing Your Flood Insurance Claim Step-by-Step

Embarking on the flood insurance claim process after hurricane Helene flooding strikes your Atlanta home requires careful navigation. Each step, from meticulously recording evidence of damage to coordinating with adjusters, impacts the outcome of your claim. In this section, we’ll guide you through capturing thorough evidence, completing claim forms accurately, liaising effectively with insurance adjusters, and comprehending the settlement process. My firsthand expertise in flood recovery will help illuminate these tasks, preparing you to handle this critical phase with confidence.

Recording Evidence of Damage Thoroughly

Through experience, I’ve grasped the critical role thorough documentation plays in the aftermath of flood damage. As you begin the claim process, take precise notes and capture extensive photographic evidence of all damage—structural, personal property, and additional living areas. It’s paramount that these records are detailed and timestamped, forming an irrefutable basis for your claim. Every crack in the foundation or water line on the wall tells a story that could influence the outcome of your compensation.

I remember feeling compelled to act quickly, knowing that diligent recording would later speak volumes when sitting down with insurance adjusters. In those initial, often chaotic moments, I made sure to document serial numbers, make models of electronics, and take close-up shots of water damage to both the interior and exterior of my home. These actions, executed promptly and meticulously, safeguarded my claim and laid the groundwork for an equitable settlement.

Completing Required Claim Forms Correctly

From my own painstaking journey through flood recovery, I know the importance of meticulously completing each section of the flood insurance claim forms. The process can be overwhelming, but accuracy is crucial — any errors or omissions could delay your claim or affect compensation. I diligently reviewed each detail, ensuring my documentation aligned precisely with what my insurance required, a tactic that helped streamline the claims process.

I keenly remember the first time I filled out a flood insurance claim form: double-checking every entry against my documented evidence provided peace of mind that all pertinent information was accounted for. This attention to detail is imperative — it ensures that the narrative of the flood‘s impact on your home is clearly communicated to the insurer. By completing these forms with precision, you can better advocate for the coverage you deserve, a lesson I’ve seen benefit both me and my fellow Atlantans.

Coordinating With the Insurance Adjuster

In the wake of a flood, coordinating with your insurance adjuster is an exercise in precision and transparency. Once the adjuster arrives, I know from experience that presenting a comprehensive portfolio of your documented losses is key. Meticulously guiding them through the extent of the damage, pointing out things they might miss, ensures they grasp the full scope of the impact on your Atlanta home.

It’s also vital to maintain open communication with the adjuster throughout the evaluation process: clarifying details, verifying their understanding of the damages, and discussing timelines for your flood insurance claim. Here’s a table I’ve found useful to track our communications and progress:

|

Action Item |

Date Completed |

Notes |

|---|---|---|

|

Initial Contact With Adjuster |

[Insert Date] |

Discussed scope of damages, arranged assessment date |

|

Adjuster’s First Visit |

[Insert Date] |

Provided damage documentation, toured property |

|

Follow-up Communication |

[Insert Date] |

Verified understanding of claims process, confirmed next steps |

Remember, the adjuster plays a pivotal role in determining the outcome of your claim. As I’ve learned, patience and attention to detail during their visits can significantly influence the accuracy and fairness of their assessment, paving the way for a just resolution to your flood insurance claim in Atlanta, GA.

Understanding the Claim Settlement Process

Delving into the settlement process after filing a flood insurance claim in Atlanta, GA involves a complex mix of patience and diligence. I know that once the insurance adjuster makes their evaluation and the claim is processed, understanding the insurer’s compensation offer is critical. Distilling their estimations down to whether they truly reflect the damage incurred and cover the necessary repairs—while considering deductibles and policy limits—is where your attentiveness to detail becomes crucial to ensure just remuneration.

Reflecting on my own experiences, receiving the actual settlement can be laden with emotions, as it marks a turning point in the recovery journey. It’s here where you’ll need to scrutinize the insurance company‘s determination, cross-referencing it with your initial calculations and records of loss to confirm the numbers align. This careful analysis is vital in negotiating any disparities, and safeguarding your right to fair coverage under the terms of your Atlanta, GA flood insurance policy.

Navigating Common Issues and Obstacles

Navigating the aftermath of a flood in Atlanta, GA, often involves challenges beyond the immediate cleanup and repair. As victims manage their road to recovery, disputes over damage assessments may arise, additional damage could surface, and understanding one’s rights under local laws becomes paramount. My insights, rooted in first-hand experience, aim to guide you through these common issues and hurdles. You’ll learn how to address conflicting assessments, tackle newly discovered damages, and assert your rights under Georgia‘s insurance laws to ensure just and fair treatment throughout your flood insurance claim process.

Dealing With Disputes Over Damage Assessments

Dealing with disputes over damage assessments can be a common stumbling block in the flood insurance claim process. From personal involvement, I’ve seen cases where the insurance adjuster’s estimates don’t align with a contractor’s assessment or the homeowner’s expectations. In such instances, it’s crucial to request a re-evaluation and present your detailed documentation of the flood damage—don’t hesitate to engage with an independent appraiser if necessary to support your case.

I’ve learned that effective communication and steadfast documentation are your best allies when disputing assessments. If discrepancies arise, I address them head-on by providing additional evidence, like photos and repair quotes, and by articulating why certain damages merit different considerations. It’s important to assert your viewpoint respectfully yet confidently to reach a fair resolution with the flood insurance company.

What to Do if Additional Damage Is Discovered

When additional damages come to light post-claim filing, I’ve learned it’s essential to act without delay. A homeowner should promptly document the new findings and update their insurance company, providing comprehensive evidence of the fresh damages. It’s about protecting your interests by ensuring these additional damages are formally recognized and assessed within the confines of your already filed flood insurance claim.

Establishing a clear record is paramount when unforeseen damages emerge, and here’s an illustrative table I found essential in keeping track of the process and new discoveries:

|

Date Discovered |

Type of Additional Damage |

Action Taken |

|---|---|---|

|

[Insert Date] |

[Describe Damage] |

Notified Insurance Company |

|

[Insert Date] |

[Describe Damage] |

Gathered and Sent Additional Documentation |

Reflecting on past flood insurance claims, the importance of updating your claim expediently cannot be overstated: each additional damage impacts your recovery trajectory and potential settlement. Securing a revised assessment from your insurance adjuster ensures that all flood-related damages to your Atlanta home are accounted for in your claim, thereby facilitating a more comprehensive settlement.

Understanding Your Rights Under Georgia Law

As you seek to understand your rights under Georgia law regarding flood insurance claims, it’s vital to recognize that these laws are designed to safeguard your interests as a homeowner. For instance, Georgia‘s insurance regulations require companies to handle claims promptly and fairly, and there are clear processes for when a dispute arises. Having been through the complex aftermath of a flood, I recommend familiarizing yourself with the Georgia Department of Insurance‘s guidelines, which offer critical protections to homeowners in Atlanta navigating flood claim hurdles.

However, flood insurance claims can work differently since flood insurance falls under the federal program or typically non-admitted private flood insurance companies. This means the claims appeal process will be different ith NFIp than it will be with private flood insurance in Georgia.

Furthermore, Georgia law entitles you to a transparent insurance process, allowing you to request a detailed written explanation for any claim denial. In my journey as a homeowner who has faced insurance challenges firsthand, tapping into this resource proved invaluable: it empowered me to question and resolve issues that initially appeared unfathomable. Here’s a table exemplifying the steps to ensure your rights are respected:

|

Step |

Action |

Georgia Law Provision |

|---|---|---|

|

Flood Claim Filing |

Submit claim documentation promptly |

Ensures timely processing under state regulations |

|

Claim Dispute |

Seek a detailed written explanation |

Right to transparency and fair handling of claims |

|

Denial Assessment |

Request reconsideration or file a complaint |

Legal remedies for unsatisfactory claim resolution |

Maximizing Your Claim and Recovery

Navigating flood insurance claims in Atlanta, GA, can be streamlined with the right approach. My aim in this guide is to equip you with tips for a smooth claim experience, highlighting valuable resources available for Atlanta residents. Moreover, I will delineate strategies for effectively planning for future flood events, ensuring you’re prepared when Mother Nature decides to test our resilience once more.

Tips for a Smooth Claim Experience

In my quest to ensure homeowners in Atlanta, GA, achieve a seamless flood insurance claim process, I’ve gathered pivotal insights. A crucial tip is to always initiate claims as soon as possible, which typically leads to prompt assessments and settlements. Additionally, maintain a thorough log of all communications with your insurance provider; this log will be invaluable in case of discrepancies or disputes about your flood insurance claim.

Secondly, as a flood insurance expert, I’ve observed that working closely with an insurance adjuster and providing detailed, concise damage reports can greatly expedite the claims process. To facilitate a smooth experience, be prepared to expound on the specifics of your flood damage claim using clear, direct language, supporting your case with the meticulous evidence you’ve collected.

Resources Available for Atlanta Residents

Atlanta residents who are navigating the complexities of flood insurance claims have various resources at their disposal. The Atlanta Flood Map Service Center, offered by FEMA, is a valuable tool where homeowners can access up-to-date flood risk information. Additionally, the Georgia Emergency Management and Homeland Security Agency guides preparing for floods, including steps to take before, during, and after an event to ensure safety and swift recovery.

For personalized support, the Georgia Department of Insurance stands ready to assist with insurance-related queries and disputes. They offer comprehensive materials on understanding your policy and your rights as an insurance holder, which is paramount for maximizing your claim and ensuring you receive fair treatment:

|

Resource |

Service Provided |

Contact Information |

|---|---|---|

|

Atlanta Flood Map Service Center |

Flood Risk Maps, Flood Zone Information |

Online via FEMA Website |

|

Georgia Emergency Management and Homeland Security Agency |

Preparation and Recovery Resources |

georgiawatch [dot] org |

|

Georgia Department of Insurance |

Assistance with Insurance Claims and Policies |

1-800-656-2298 |

Planning for Future Flood Events

From my experience, preparing for future flood events is about staying one step ahead. After filing a flood insurance claim in Atlanta, I advise homeowners to reassess their coverage and ensure it aligns with their current needs. A well-mapped out flood plan, reflecting the latest flood zone data for Atlanta, Georgia, can shield you from unforeseen losses and give you the foresight to better protect your property.

Having endured the rigors of flood recovery, I can’t understate the value of proactive measures like installing flood defenses and keeping an updated inventory of your possessions. By understanding the specific flood risks in Atlanta, GA, and reflecting these in your flood readiness strategies, you’ll position yourself for a more resilient tomorrow. Ensuring a robust flood insurance policy is in place is not just a safety net; it’s a strategic step for peace of mind in our storm-prone city.

Frequently Asked Questions

What does flood insurance in Atlanta, GA typically cover?

Flood insurance in Atlanta, GA typically covers structural damage, essential systems, personal belongings, and some cleanup expenses after a flooding event.

How can I prepare my Atlanta home for potential floods?

To prepare your Atlanta home for potential floods, elevate utilities, install backflow valves, and reinforce waterproofing, focusing on flood mitigation strategies to safeguard your property.

What are the first steps after experiencing a flood?

After a flood, immediately document the damage, contact your insurance company, and prioritize safety by avoiding electrical hazards in your Atlanta home.

Can you walk me through the claim filing process?

Certainly, to file a flood insurance claim in Atlanta, promptly report the damage to your insurer, document all impacts thoroughly, and complete the insurer’s claim forms, keeping close track for any follow-up.

What should I do if my flood claim faces obstacles?

If your flood claim in Atlanta faces hurdles, promptly document the issues, consult with your insurance agent, and consider seeking guidance from a flood insurance claims expert or attorney if necessary.

Conclusion

Navigating flood insurance claims in Atlanta, GA, requires a keen understanding of policy differences, documentation practices, and actionable recovery steps. Homeowners need to familiarize themselves with the intricacies of their policies, ensuring they have robust coverage tailored to Atlanta‘s unique flood risks.

Proactive documentation and inventory of property significantly streamline the claims process, allowing for efficient recovery after a flood. By preparing in advance and understanding the claims procedure, Atlanta residents can secure the financial protection they need against the unpredictability of natural disasters.

Information contained on this page is provided by an independent third-party content provider. This website make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact editor @producerpress.com