Easy-to-Understand Flood Risk Tools: What Every Homeowner Should Know

Do flood maps and insurance language leave you totally lost?

You’re not alone. Many homeowners want to understand their flood risk but run into maps, terms, and tools that feel designed for engineers, not everyday people.

Confused about whether your home is even at risk, or how to protect it properly?

This confusion is exactly what leads people to delay getting flood insurance or make decisions based on outdated or misunderstood information.

The good news? You don’t need a background in environmental science or insurance to understand your flood risk.

In this article, we’ll break down 5 free, easy-to-use tools that give you a clear picture of your risk and explain exactly how to use them.

Why Flood Risk Feels So Hard to Understand

Flood risk data is important—but it’s rarely easy to interpret.

Here’s why most homeowners feel overwhelmed:

- FEMA maps are technical

They’re filled with elevation levels, zones (like AE or VE), and confusing notations. - Insurance terms make it worse

Ever tried reading about “base flood elevation” or “actuarial zone mapping” without falling asleep? - There’s no clear entry point

You’re faced with an overwhelming wall of documents, PDFs, and search results.

But you don’t need to become a flood insurance expert. You just need the right tools—and the right guide.

5 Tools That Make Flood Risk Easy to Understand

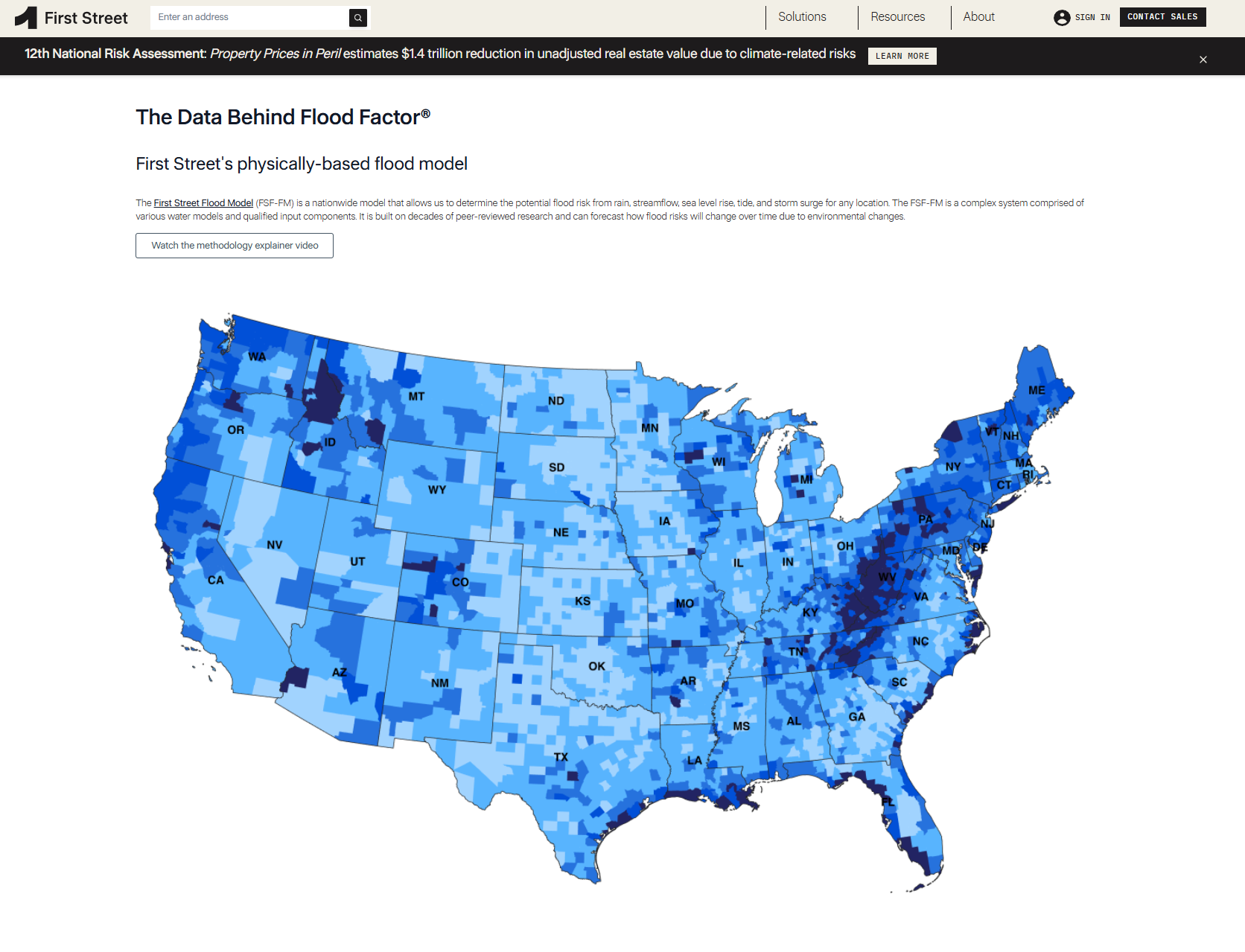

1. FloodFactor.com

Flood Factor is one of the most user-friendly tools for assessing flood risk by address.

✅ What it shows:

- Risk level from 1 to 10

- Visual map of expected future flooding

- 30-year flood risk projection

- Potential damage estimates

✅ Why it helps: It’s visual, easy to read, and doesn’t require an account.

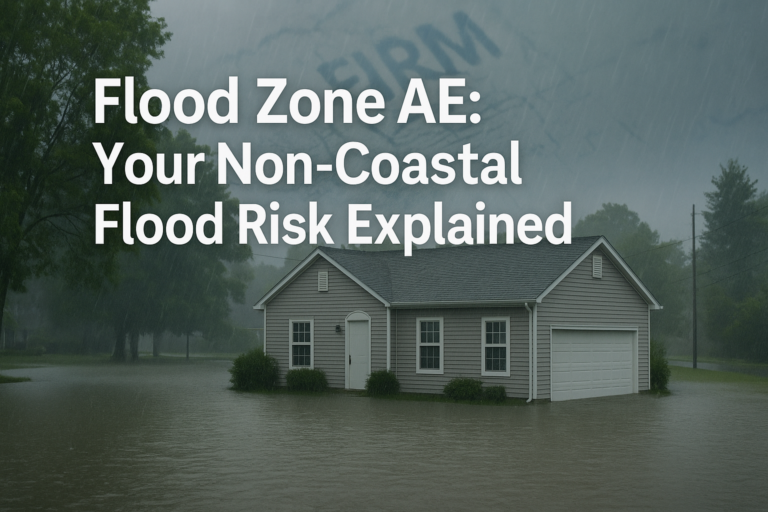

2. FEMA Flood Map Service Center

This is the official government tool for identifying your FEMA-designated flood zone.

✅ What it shows:

- Your zone designation (e.g., Zone AE, VE, X)

- Base Flood Elevation (BFE)

- Downloadable Flood Insurance Rate Maps (FIRMs)

✅ Why it helps: It’s the most official resource used by agents, underwriters, and lenders.

Tip: Use this tool if your lender requires flood insurance or you want to appeal your zone.

3. FloodSmart.gov

FEMA’s educational site for policyholders and shoppers.

✅ What it shows:

- Explanation of NFIP coverage (building vs contents)

- Average premium estimates

- Risk reduction and mitigation options

- Common claims examples

✅ Why it helps: It makes FEMA coverage more understandable for everyday users.

4. The Flood Insurance Guru Video Library

We’ve created hundreds of short videos that break down confusing flood terms and risk issues into clear, relatable lessons:

✅ What it covers:

- Risk Rating 2.0 Changes

- FEMA vs Private Flood Coverage Breakdowns

- How elevation affects premiums

- Real-life case studies and walkthroughs.

✅ Why it helps: You can search by topic, pause to take notes, and finally understand what your policy or flood zone means.

5. Your Local Floodplain Manager

Your city or county likely has a designated official responsible for floodplain oversight.

✅ What they offer:

- Help reading FEMA maps.

- Insight into local flood mitigation efforts.

- Community-specific assistance programs

✅ Why it helps: Local knowledge can reveal resources or risks that national tools might miss.

Pro Tip: Call your local planning or zoning department to ask, “Do you have a floodplain manager I can speak with?”

Want to understand how these tools affect your insurance rates? Read: “What Risk Rating 2.0 Means for Your Premium”.

How to Use These Tools Together (Without Getting Overwhelmed)

Use this quick-start strategy:

- FloodFactor for your visual risk profile

- FEMA Map Service Center for your official zone

- FloodSmart.gov to learn about coverage and mitigation

- Flood Insurance Guru Videos to understand your unique situation

- Floodplain Manager to learn about local tools and programs

Keep screenshots and notes handy—they’re great to reference during a policy review or quote.

Conclusion

You now have five powerful tools at your fingertips to better understand your flood risk, without needing to decode a FEMA manual. You’re not the only one who’s felt confused. But taking just a few minutes with the right tools can give you real clarity and confidence.

Check your home’s flood risk using the tools above, and when you’re ready, connect with someone who can help you take action.

At The Flood Insurance Guru, we translate flood risk into everyday language—and help you find coverage that fits your situation.

Information contained on this page is provided by an independent third-party content provider. This website make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact editor @producerpress.com