Top Washington insurance News

-

5 ways to find affordable care without health insurance

Health policy changes in Washington will ripple through the country, resulting in millions of Americans losing their Medicaid or Affordable Care Act coverage. But there are still ways to find care. Over the next decade, the GOP’s One Big Beautiful Bill Act is expected to slash nearly $1 trillion in spending from Medicaid, the state-federal

-

Health insurance CEOs grilled on high costs of care in back-to-back House hearings

WASHINGTON — Lawmakers on both sides of the aisle pressed health insurance CEOs on premium hikes, prior authorization rules and claim denials in back-to-back House committee hearings Thursday, zeroing in on how the insurers’ decisions are affecting patients right now. The CEOs of UnitedHealth Group, CVS Health Group, Cigna Health Group, Elevance Health and Ascendiun

-

Farmers Now Owe a Lot More for Health Insurance

Meghan and John Palmer own Prairie Star Farm in Allamakee County, Iowa. They say rising health care costs add to the financial pressures many farm families face.(Meghan Palmer) Last year was a tough one for farmers. Amid falling prices for commodity crops such as corn and soybeans, rising input costs for supplies like fertilizer and

-

4 House Republicans Join Democrats to Force Vote on ACA Tax Credits Extension

Millions of Americans’ health insurance premiums could double if the credits aren’t renewed by the end of this year. A sign that reads “Affordable Care Act Premiums Will Rise More Than 75%” during a news conference led by Democrats to call on Republicans to pass Affordable Care Act tax breaks on Capitol Hill on September

-

Republicans defy Johnson to force House vote on extending health insurance subsidies

WASHINGTON — Four House Republicans broke with party leadership on Wednesday to join Democrats in overriding the GOP majority and forcing a vote on extending healthcare tax credits — a defection that underscores the party’s growing vulnerability on economic issues ahead of next year’s midterm elections. The healthcare tax credits, which were central to the fight that

-

Poll: Most are satisfied with their health insurance, but a quarter report denials or delays

An overwhelming majority of U.S. adults are satisfied with their health insurance coverage overall, including most older Americans and those on Medicare and Medicaid, according to a new NBC News Decision Desk Poll powered by SurveyMonkey. But there is an undercurrent of frustration in the findings, too, with nearly one-quarter of respondents saying they’d been

-

Sticker Shock: Obamacare Customers Confront Premium Spikes as Congress Dithers

We’ve been here before: congressional Democrats and Republicans sparring over the future of the Affordable Care Act. But this time there’s an extra complication. Though it’s the middle of open enrollment, lawmakers are still debating whether to extend the subsidies that have given consumers extra help paying their health insurance premiums in recent years. The

-

Senate rejects 2 rival health care proposals as higher insurance costs loom

NEW YORK (AP) — When senators voted on rival health bills Thursday, they had two chances to address expiring COVID-era subsidies that will result in millions of Americans saddled with higher insurance costs in the new year. But the Senate rejected both, and hopes of solving the problem this year are running dry. Affordable Care

-

Swing District Republicans Brace for Political Fallout if Obamacare Subsidies Expire

You don’t have permission to access “http://www.medpagetoday.com/washington-watch/washington-watch/118896” on this server. Reference #18.16d9c217.1765265230.7dd49f3a https://errors.edgesuite.net/18.16d9c217.1765265230.7dd49f3a

-

Swing district Republicans brace for fallout over health care

ALLENTOWN, Pa. (AP) — Republicans in key battleground U.S. House districts are working to contain the political fallout that may come when thousands of their constituents face higher bills for health insurance coverage obtained through the Affordable Care Act. For a critical sliver of the Republican majority, the impending expiration of what are called enhanced

-

New poll shows ACA enrollees are struggling with health costs

WASHINGTON (AP) — Fifty-two-year-old Dinam Bigny sank into debt and had to get a roommate this year, in part because of health insurance premiums that cost him nearly $900 per month. Next year, those monthly fees will rise by $200 — a significant enough increase that the program manager in Aldie, Virginia, has resigned himself

-

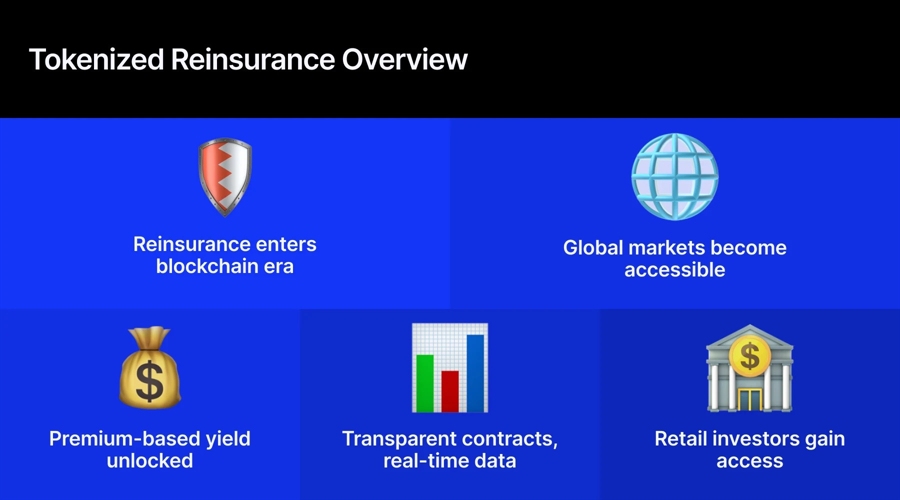

Retail Investors Tap Trillion-Dollar Reinsurance Markets via Tokenized DeFi Platforms

2025-12-03T15:53:12.015+02:00 W e d n e s d a y , 0 3 / 1 2 / 2 0 2 5 | 1 3 : 5 3 G M T by Mohadesa Najumi Tokenized reinsurance blends decentralized capital and automated underwriting; Insurance Capital Layers share risk. Insurance Capital Layers let investors join tokenized reinsurance, blending

-

What to watch for in Tennessee tonight: From the Politics Desk

Welcome to the online version of From the Politics Desk , a newsletter that brings you the NBC News Politics team’s latest reporting and analysis from the White House, Capitol Hill and the campaign trail. In today’s edition, Steve Kornacki previews tonight’s special House election in Tennessee. Plus, Sahil Kapur reports on the lack of

-

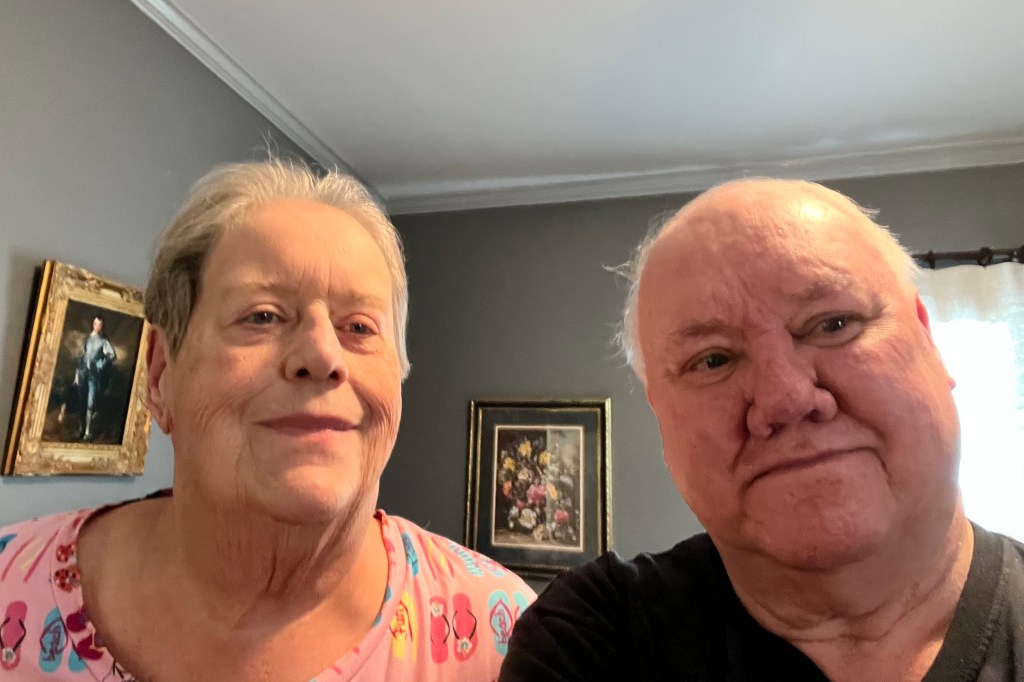

After Shutdown, Federal Employees Face New Uncertainty: Affording Health Insurance

Larry Humphreys, a retired Federal Emergency Management Agency worker in Moultrie, Georgia, says he and his wife won’t be traveling much next year after their monthly health insurance premium payment increases more than 40%, to $938. Humphreys, 68, feels betrayed by the Federal Employees Health Benefits Program. “As federal employees, we sacrificed good salaries in

-

Obamacare tax credits look likely to expire as Trump rules out an extension

WASHINGTON — Inside a closed-door meeting of House Republicans on Tuesday, Rep. Jen Kiggans, a swing district member who is a linchpin of the party’s narrow majority, stood up and made a plea. “Doing nothing on health care is not the right answer,” the Virginia Republican later told NBC News, summing up her message to

-

As health insurance bills rise, Republicans are still seeking an Obamacare alternative

WASHINGTON — House Speaker Mike Johnson says he still has “PTSD” from the GOP’s failed effort to repeal and replace the Affordable Care Act during President Donald Trump’s first term. Now, the party is about to plunge back into the tricky policy debate that once cost them seats in the House. This time around, though

-

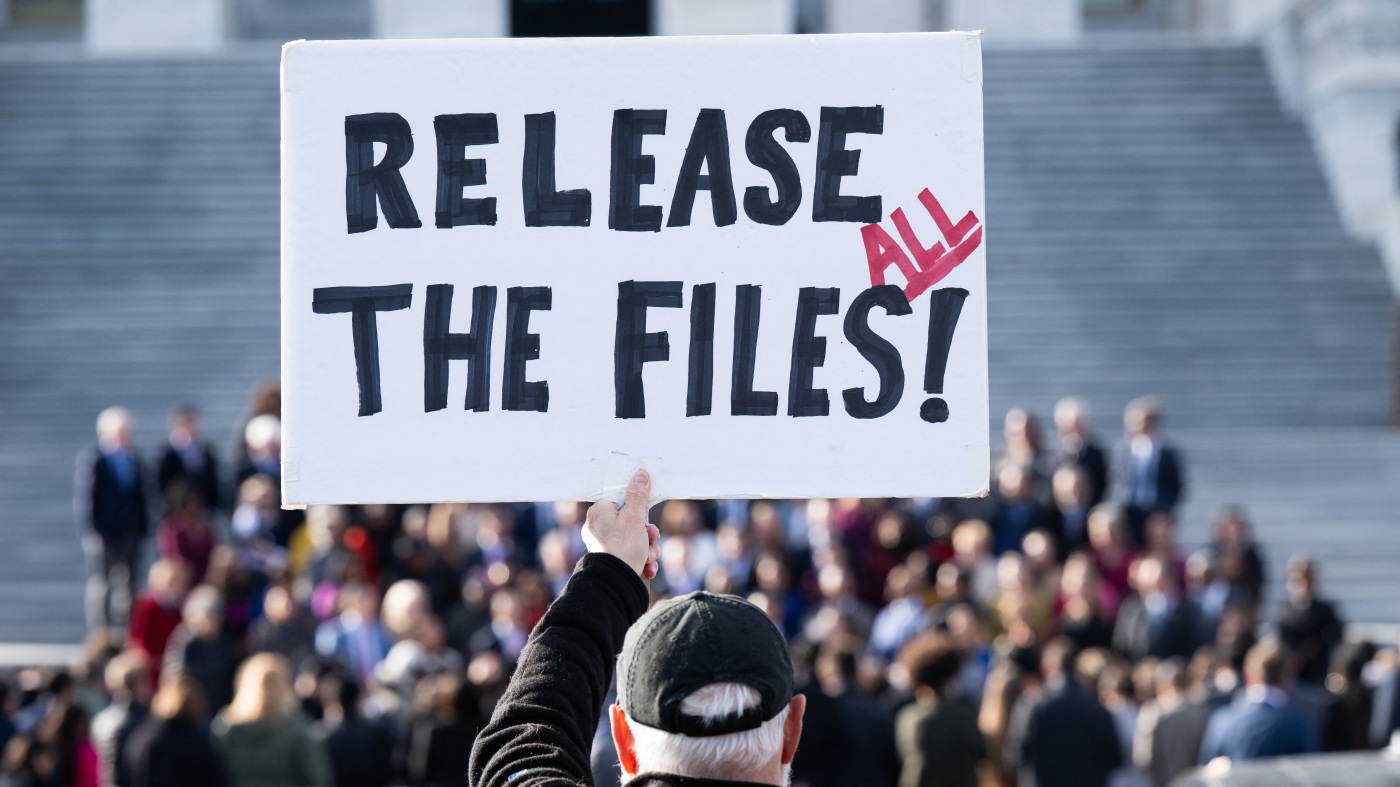

What new Epstein emails say. And, ACA subsidies in limbo

Epstein Documents Dump, Government Reopens, Affordable Care Act Limbo Good morning. You’re reading the Up First newsletter. Subscribe here to get it delivered to your inbox, and listen to the Up First podcast for all the news you need to start your day. Today’s top stories The House Oversight Committee yesterday released over 20,000 documents turned over to Congress

-

House set to vote on deal to end shutdown amid Democratic splits – US politics live

House Democrats release emails that allege Trump knew about Epstein’s crimes In a new batch of emails released by Democrats on the House oversight committee, Jeffrey Epstein wrote that Donald Trump knew about the late financier and sex-offender’s crimes. In the three emails released, Epstein apparently told his accomplice Ghislaine Maxwell that Trump “spent hours”

-

The 2 factors driving your health care costs higher and higher

It’s that time of year again: open enrollment. With it comes a lot of questions: Do I go with an HMO or a PPO? Do I need an FSA or an HSA? What’s my deductible again? It’s very confusing, but one thing is clear: The cost of your health insurance is likely going up. Premiums

-

Trump tells Senate Republicans to send federal health insurance money ‘directly to the people’

U.S. President Donald Trump gestures as he speaks during an event to announce a deal with Eli Lilly and Novo Nordisk to reduce the prices of GLP-1 weight‑loss drugs, in the Oval Office at the White House in Washington, D.C., U.S., November 6, 2025. Jonathan Ernst | Reuters President Donald Trump proposed a compromise on

-

Will A Not-At-Fault Accident Affect My Insurance Rate?

Joe & Casey – Insurance Deep Dive Will A Not-At-Fault Accident Affect My Insurance Rate? Source: Mid-Columbia Insurance Not-At-Fault Accidents: Understanding Insurance Rate Impacts When Another Driver Hits Your Car Not-at-fault accidents affect your auto insurance rates based on multiple…

-

How Traffic Tickets Impact Your Insurance Rates

Joe & Casey – Insurance Deep Dive How Traffic Tickets Impact Your Insurance Rates Source: Mid-Columbia Insurance Traffic tickets in Washington directly impact your driving privileges and insurance costs, with citations potentially increasing premiums by $22 monthly for three years….

-

Insurance in Kennewick WA

Regardless of what sort of car or pickup you have, you need to have car insurance. Not simply to keep from getting a traffic ticket but also to secure your assets if you cause an accident in Kennewick. Driver’s License…

-

Dairyland Snowmobile Insurance

You only have a brief window of time to ride your snowmobile on the trails. If an accident happens, you want to resume riding as quickly as possible, with your sled restored to top condition. Mid-Columbia Insurance can help you…

-

Protecting Your Vehicle: Essential Tips from the NICB

Joe & Casey – Insurance Deep Dive Protecting Your Vehicle: Essential Tips from the NICB Source: Mid-Columbia Insurance With a vehicle being stolen every 30 seconds in the United States, protecting your car has never been more important. The National…

-

Permissive Use: Can My Friend Borrow My Car?

Joe & Casey – Insurance Deep Dive Permissive Use: Can My Friend Borrow My Car? Source: Mid-Columbia Insurance Lending your car to a friend or family member? Understanding permissive use in your car insurance policy is crucial for protecting both…

-

Car vs Pedestrian in Kennewick & Auto Liability Insurance

Joe & Casey – Insurance Deep Dive Car vs Pedestrian in Kennewick & Auto Liability Insurance Source: Mid-Columbia Insurance On Sunday evening, a 46-year-old man was critically injured after being struck by a pickup truck on West 10th Avenue near…

-

Broadform Insurance

What Is Broadform Insurance? Broadform Insurance is insurance for a specific driver (you) to drive owned and non-owned private passenger vehicles instead of insuring a specific car. Broadform Insurance is commonly called “Drivers License Insurance” because it covers the named…

-

Quotes For SR-22 Insurance in Tacoma WA

Even though it’s frequently mistakenly thought of as insurance, SR-22 insurance is simply a document your insurance provider submits to the state to confirm you have active insurance coverage. The majority of Tacoma insurance companies don’t want to deal with…

-

Pasco Rollover Accident & Personal Injury Protection (PIP)

Joe & Casey – Insurance Deep Dive Pasco Rollover Accident & Personal Injury Protection (PIP) A recent rollover accident in Pasco that sent two people to the hospital serves as a stark reminder of how quickly life can change on…