Understanding Flood Insurance Costs in Savannah, GA

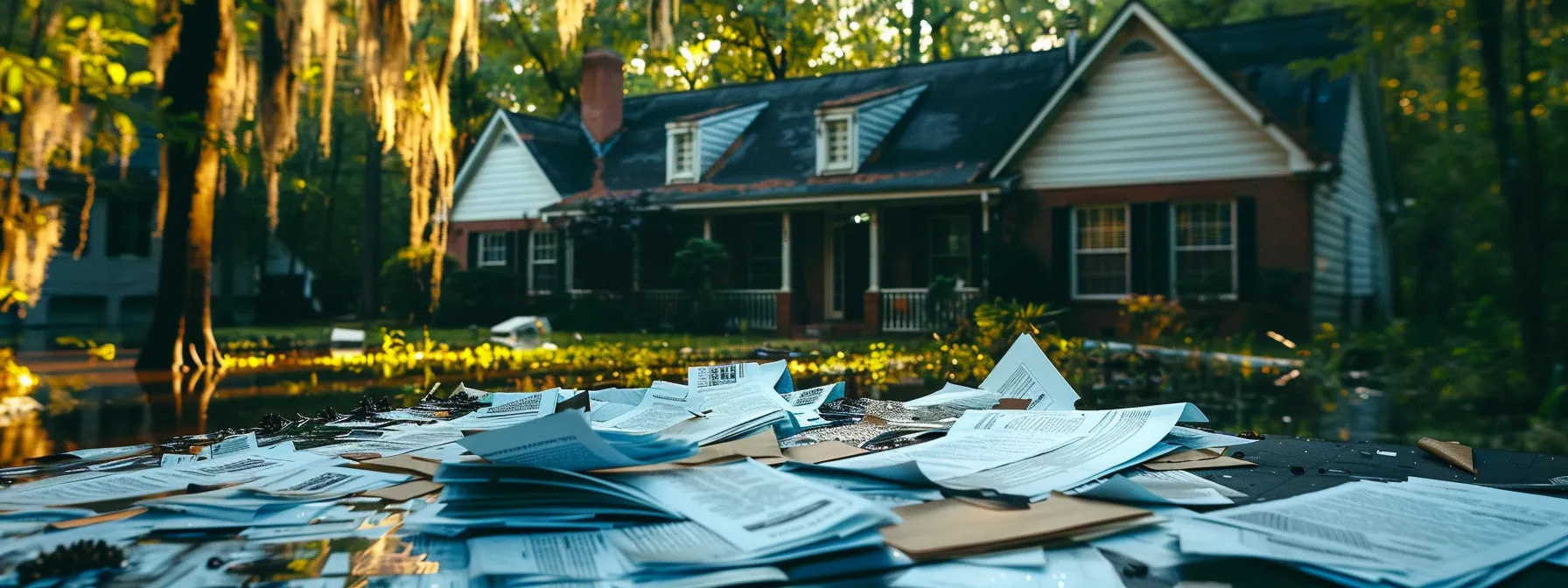

Navigating the flood plains of Savannah, Georgia, you’ll find that protecting your property with the right insurance policy isn’t just prudent—it’s a necessity. Flash floods can occur unexpectedly, leaving homeowners to grapple with the aftermath without adequate coverage.

Choosing the appropriate flood insurance policy requires a keen understanding of both the local landscape and the nuances of insurance plans available in Georgia. To ensure you’re not caught off guard by exorbitant premiums, this guide will illuminate the various aspects that impact the cost of flood insurance in Savannah.

Keep reading to arm yourself with knowledge that could save you from unnecessary financial stress in the face of natural disasters.

Exploring the Need for Flood Insurance in Savannah, GA

As you delve into the landscape of flood insurance in Savannah, GA, understanding the historical context of flooding in the area becomes paramount. Savannah’s storied past with water – from river overflow to hurricanes – necessitates an in-depth analysis of the flood history to comprehend the insurance needs thoroughly. Moreover, evaluating your property‘s specific flood risk in Savannah isn’t merely a suggestion; it’s a necessity that can influence not only your peace of mind but also the requirements set forth by mortgage lenders.

The National Flood Insurance Program (NFIP), managed by the Federal Emergency Management Agency (FEMA), provides guidelines for flood insurance, but the onus falls on you, the homeowner, to assess risk and ensure adequate coverage. Making informed decisions about insurance hinges on knowing the intricacies of Savannah’s flood risk and how it can impact your home and finances.

Analyzing Savannah’s Flood History

When you consider securing your home in Savannah, it’s essential to look at the tapestry of flood events that have shaped insurance needs. Savannah has withstood numerous storms, each serving as a reminder that home insurance needs to encompass robust flood coverage, with a deductible structured to protect your financial well-being as surely as life insurance safeguards your family’s future. For more detailed information on how to prepare for hurricane season and mitigate flood risks in this area, a focused resource provides essential insights. Preparing for hurricane season in Savannah, Georgia

Understanding the dance of water and land over time in Savannah informs the way you prepare for possible storm damage. The interplay between the Savannah River’s levels and coastal surges can’t be ignored; it’s a partnership that can turn turbulent with little warning, emphasizing the importance of having home insurance that considers the full spectrum of water-related risks.

|

Event |

Year |

Impact on Savannah |

|---|---|---|

|

Flood Waters |

Multiple Occurrences |

Historic flooding, prompting insurance claim spikes |

|

Coastal Storms |

Ongoing Threat |

Increased scrutiny of flood zones; higher premiums |

Assessing Your Property‘s Flood Risk in Savannah

Gauging the flood risk for your Savannah home necessitates a meticulous data analysis that intertwines local topography, historical flood patterns, and the latest emergency management advisories. When armed with this information, you can navigate the intricacies of flood insurance choices and secure a policy that reflects the true cost of protecting your property against unpredictable water levels.

Disregard the common misconception that flood insurance is extraneous if your home isn’t in an officially designated high-risk zone. Advertising may not tell the full story; floods can manifest beyond these boundaries, often leading to out-of-pocket expenses that could have been mitigated with the right insurance plan. Therefore, it’s imperative to accurately assess your property‘s flood risk and invest in a policy that provides financial safeguards against such emergencies. For more insights on why you might need flood insurance even if you are not in a recognized flood zone, consider reading more about not in a flood zone.

Breaking Down the Cost of Flood Insurance in Savannah, GA

When you’re evaluating the costs for flood insurance in Savannah, GA, key factors come into play that determine the rates you’ll encounter. Companies such as Liberty Mutual and general insurance providers calculate premiums based on a variety of determinants, including your home’s location within flood zones, historical claims, and structural particulars.

These factors are intertwined with financial elements like the terms of your loan and the extent of liability insurance required. Additionally, your credit history may have a subtle influence on insurance rates, even in the realm of flood coverage. Grasping these variables is crucial as they can significantly sway the average insurance costs you’ll face, differing markedly from one zone to another across Savannah.

Understanding Rate Determinants for Savannah Homes

Your home’s elevation within a floodplain is a primary component influencing flood insurance rates in Savannah, GA. The higher your home is above the base flood elevation, the less likely it is to incur flood damage, which may lead to lower insurance costs. An accurate elevation certificate, therefore, becomes a vital document, offering you the option to potentially reduce your premium.

If your home boasts a basement, expect that feature to press the scales in terms of your insurance rates. Basements are particularly vulnerable to flooding, which necessitates additional consideration for personal property protection within that space. Insurers will carefully weigh this aspect, alongside the rest of your home’s flood risk, to determine your rates. For more insight into how these factors specifically impact your insurance rates, a closer look at Georgia flood insurance rates might provide valuable information.

Average Insurance Costs by Zone in Savannah

Assessing flood insurance costs by zone in Savannah requires attention to detail since premiums vary significantly across different areas. While a mobile home may attract lower initial investment costs, in certain designated flood zones this type of dwelling could see heightened insurance rates, especially if recent metrics suggest an increased likelihood of flooding comparable to the risks faced in coastal Alabama.

As you shift focus to a bustling urban area like Atlanta, which lies farther from the coast yet isn’t immune to natural disasters, flood insurance costs might feel more moderate due to differing flood risk assessments. It’s crucial to consider that these variations reflect the intricate balance insurers must strike between location-specific risks and regional claims history:

|

Zone |

Location Category |

Typical Cost Range |

|---|---|---|

|

A |

High Risk |

$1,000 – $3,000 |

|

B, C, X |

Moderate to Low Risk |

$500 – $1,500 |

|

D |

Undetermined Risk |

Varies significantly |

Keep in mind that these numbers are guides; exact costs can only be ascertained through a detailed evaluation of your property‘s specifications and location within Savannah’s unique flood zones. It remains essential to consult with an insurance specialist who can navigate the intricacies of your coverage needs and provide personalized rate information.

Key Factors Influencing Flood Insurance Prices in Savannah

As you gather information to understand flood insurance costs in Savannah, GA, it’s essential to consider how various factors distinctly influence premiums. Your zip code alone can usher in a significant difference in rates, since it typically corresponds with designated flood zones—a key determinant in pricing.

Beyond the location, the replacement value of your property plays a pivotal role, with higher-valued homes likely commanding greater premiums. Similarly, building materials used in construction may affect your rates, with some materials being more resistant to flood damage than others. Proximity to water bodies also factors into the equation, generally resulting in increased costs for those closer to potential flood sources. Lastly, your home’s elevation relative to the community‘s base flood elevation standard affects premiums, often rewarding those situated at higher elevations with lower rates.

This intricate web of determinants is further clarified through FAQs provided by insurance carriers, aiming to equip you with data-driven insights tailored to your specific needs in Savannah.

The Impact of Flood Zones on Insurance Costs

If you’re contemplating the nuances of property insurance in Savannah, bear in mind that flood zones considerably affect the cost. A residence within a high-risk zone may suffer higher insurance rates due to the increased likelihood of water damage, translating into a heftier expense for homeownership. It’s important to remember the National Flood Insurance Program (NFIP) no longer uses flood zones for insurance rates in Savannah GA.

When exploring refinancing options, be conscious that the company underwriting your property insurance will assess flood zone reclassifications that could alter your premiums. Adequate coverage against water damage becomes a strategic aspect of financial planning, as rescission to a lower-risk zone might result in more favorable insurance terms. For more detailed insights on navigating these changes, you might find the article on navigating flood zone changes for property value particularly useful.

Property Replacement Value and Its Effect on Premiums

When you assess the landscape of flood insurance as a Savannah homeowner, know that the replacement value of your home can tilt the scales in the realm of finance: a higher-valued house typically requires higher premiums. It’s a balancing act between protecting your investment and managing ongoing costs, compelling a need to compare home insurance policies meticulously.

An insurance company factors in the potential cost to rebuild your home when setting flood insurance rates. This means that, unlike renters insurance which covers possessions, your flood insurance is heavily dependent on the replacement value of the structure itself. So, when you compare home insurance offerings, understanding the figures tied to rebuilding can position you for better financial preparedness against flood risks.

|

Replacement Value Bracket |

Estimated Premium Range |

|---|---|

|

$100,000 – $200,000 |

$600 – $1,200 |

|

$200,001 – $300,000 |

$1,200 – $2,400 |

|

Above $300,000 |

$2,400 and up |

How Building Materials Affect Your Rates

As Savannah homeowners navigate the nuances of their home insurance policy, the chosen building materials can greatly influence the premium of their homeowners insurance. Durable materials designed to withstand flood conditions may lead to reduced insurance quotes as they offer the promise of greater resilience against potential water damage.

When obtaining an insurance quote, Georgia home insurance providers consider the susceptibility of a house’s structure to flood damage, and this extends to the building materials used. If your home showcases water-resistant materials, this foresight can mitigate risk and thus, favorably impact your flood insurance rates.

How Distance to Water Impacts Premiums

If your Savannah property sits close to bodies of water like rivers or the coast, insurance companies often deem the risk of flooding higher, which can make commercial flood insurance a considerable expense. When requesting a flood insurance quote, georgia homeowners insurance providers assess this proximity, as homes near water sources generally incur higher premiums to offset the increased chance of flood damage.

Conversely, if your residence is situated further from immediate water threats, home insurance companies may offer more favorable terms on flood insurance. This reflects the lower risk your property poses in their eyes, potentially leading to reduced rates on your Georgia homeowners insurance policy that includes flood coverage.

How Elevation Impacts Premiums

The elevation of your Savannah residence crucially determines homeowners insurance rates, directly affecting how underwriting experts calculate your flood risk. Properties situated above the region’s base flood elevation are typically viewed as a reduced hazard, leading to more affordable flood insurance premiums.

|

Elevation in relation to Base Flood Elevation (BFE) |

Impact on Homeowners Insurance Rates |

|---|---|

|

Above BFE |

Reduced premium due to decreased flood risk |

|

At or Below BFE |

Increased premium reflecting higher vulnerability to flooding |

As a homeowner in Savannah’s fluctuating real estate market, you appreciate that your property‘s location and structure play pivotal roles in insurance matters; elevation is a feature that underwriting specialists carefully scrutinize to tailor services to each customer’s needs. A favorable elevation can substantially mitigate potential costs and contribute to securing more favorable terms for your flood coverage.

Comparing Flood Insurance Providers in Savannah, GA

In Savannah, where rain patterns and the potential for severe weather loom large, homeowners must weigh their options between the National Flood Insurance Program (NFIP) and private insurance offerings. As you evaluate the protection for your dwelling, it’s important to consider both coverage limits and prices, which differ between these programs.

Seeking the right balance in your personal finance requires a keen look at customer satisfaction records and policy benefits that accommodate the unique flood risks in the region. It’s critical to employ foresight and due diligence as you sift through the various insurance plans, ensuring that when the skies open, your home and finances remain secure.

NFIP Versus Private Insurance Options

When you’re weighing your options between the National Flood Insurance Program (NFIP) and private insurance providers for coverage in Savannah, it’s akin to comparing electricity services across various states—each market carries its unique attributes. While NFIP is a federal program with standardized rates and coverage, akin to the models seen across states like Tennessee, private insurers in Georgia offer varying premium rates and policies, reflecting the competitive dynamics you might find in the California insurance landscape.

Exploring private insurance as an alternative to NFIP could be beneficial, much like Virginia residents might find certain market-based electricity plans more suited to their needs. Private insurers may offer higher coverage limits or additional benefits not found with NFIP policies, affording you a tailored approach to flood insurance—one that aligns with Savannah’s specific challenges and your personal risk profile.

Evaluating Coverage Limits and Prices

As you examine flood insurance options in Savannah, consider how coverage limits affect the protection of your assets, including furniture. When renting close to the coast, higher coverage limits may be advisable, yet this will influence the price you pay. Balance the potential cost against the likelihood and severity of flood damages to ensure your policy meets your specific needs.

While navigating the flood insurance market, scrutinize the terms of service of each plan. Providers in Savannah may offer diverse terms with varying costs, and these will dictate the extent to which you’re covered for flood events. Carefully assess these details to secure an insurance policy that offers peace of mind without compromising on necessary financial protection.

How to Optimize Your Flood Insurance Spending in Savannah

With Savannah’s susceptibility to extreme weather events—from the unforgettable devastation of Hurricane Harvey to the seasonal risks of tornadoes—securing flood insurance is more of an experience in prudence than an optional add-on. In the same breath as you maintain your air conditioning to brave the sweltering summer heat, consider optimizing your flood insurance to safeguard your home and finances with equal fervor.

Fortunately, there are practical steps you can take to mitigate the premiums—much like creating defensible space to protect against wildfire. Whether by implementing elevation adjustments to your property or exploring various insurance offerings, you’ll find that arming yourself with knowledge can lead to substantial savings while maintaining robust protection for your Savannah home.

Tips for Lowering Flood Insurance Premiums

One strategy for reducing your flood insurance premiums in Savannah is to ensure your home employs flood-resistant construction techniques. By updating your home’s plumbing and electrical systems to meet current floodplain management standards, you not only enhance the safety of your furnishings and electronics but also present a lower risk profile to insurers, which can lead to lower premiums. For more insights on reducing flood insurance costs, consider 5 tips to buying flood insurance.

Consider elevating your home’s critical systems: raise electrical outlets, switches, and circuit breakers as well as HVAC components to reduce their exposure to flood damage. Safeguarding possessions, such as clothing and electronics, by storing them above potential flood levels can also demonstrate proactive risk management to insurers and help lower your insurance costs.

|

Action |

Impact on Insurance Premium |

|---|---|

|

Modernizing plumbing and electrical systems |

Lower premiums due to reduced risk |

|

Elevating home’s critical systems |

Discounts through demonstrated risk mitigation |

|

Securing appliances and valuables |

Potential for premium credits or reduced rates |

Setting aside a part of your mortgage payment into an escrow account, specifically for flood insurance, can also be a wise fiscal move. By doing so, you ensure that the premium is paid on time consistently, which can avoid lapses in coverage and may qualify you for discounted rates offered by some insurance providers for maintaining continuous coverage.

Benefits of Elevating Your Savannah Home

Raising your Savannah home above average flood levels is a prudent measure against coastal flooding that can save you more than just stress; it can save you a significant amount of money. Elevated houses often receive lower insurance premiums because they’re seen as less risky by insurers, much like homes on higher ground in states like Utah and Mississippi.

By investing in the elevation of your property, you proactively address the prevalent threat of coastal flooding in Savannah, effectively diminishing the financial impact on your insurance expenses. This forward-thinking strategy not only enhances the safety of your home but also positions you for reduced flood insurance costs in the long term.

The Procedure for Buying Flood Insurance in Savannah

As you consider your options for flood insurance in Savannah, navigating the National Flood Insurance Program (NFIP) and surveying private insurance offerings is vital in making a well-informed decision. You, the consumer, hold the power to influence the price of your policy through diligent research and a keen understanding of your specific needs.

Familiarizing yourself with the community rating system (CRS) and how it affects policy costs will help you make choices that align with your financial planning. Meanwhile, insights gained from comparing the NFIP to Michigan’s competitive insurance market could provide strategic perspective on the value offered by private flood insurance providers. Assessing the breadth of options available ensures not only protection for your home but also a sense of control over your insurance investment.

Navigating the National Flood Insurance Program (NFIP)

Embarking on the journey of securing flood insurance through the National Flood Insurance Program (NFIP) involves understanding their management of risk levels in relation to climate patterns and topographical data. Your proactive approach in comprehending these factors, along with the NFIP’s rules and procedures, can lead to more adequately protecting your Savannah home in this climate-aware era.

Through the NFIP, the collective knowledge of past flood events and current climate models shapes the policies offered. Equipped with this information, you can work with insurance specialists to tailor a coverage plan that recognizes Savannah’s environmental nuances and safeguards your dwelling against climate-induced flooding.

|

NFIP Coverage Component |

Description |

Benefit to Homeowner |

|---|---|---|

|

Flood Risk Assessment |

In-depth analysis using climate data and Savannah’s geography |

A more accurate coverage reflecting your home’s actual flood risk |

|

Premium Calculation |

Based on risk level, home value, and location |

Cost-effectiveness due to tailored premium rates |

|

Claims Management |

Structured process for post-flood recovery |

Streamlined support when you need it most |

Considering Private Flood Insurance Offerings

In your quest for optimal flood coverage in Savannah, exploring private flood insurance offerings presents a compelling choice. These policies are often customized to fit the individual needs of your property, taking into account the unique flood hazards specific to geographical nuances not always recognized by federal programs.

Turning your attention toward private insurers can afford you coverage options that may surpass the limits set by the NFIP. A consultation with a knowledgeable insurance agent specializing in the Savannah area will help you discern if these alternatives align more closely with your risk exposure and financial goals.

Filing a Flood Insurance Claim in Savannah: A Step-by-Step Guide

If your Savannah home has been impacted by a flood, timely action is critical to commence your recovery process. After ensuring your personal safety and that of your family, the next steps involve a systematic approach to secure your financial restitution through your flood insurance policy.

You’ll need to meticulously document the extent of damage, initiate your claim with precision, and brace yourself for the stages that follow—navigating intricate insurance protocols to receive compensation. This task, while painstaking, paves the way for rebuilding your property and resuming normality with the financial support your policy provides.

Let’s walk through the necessary procedures that guide you from post-flood disarray to the restoration of your cherished home.

Initial Steps After a Flood Event

After floodwaters retreat from your Savannah property, promptly contact your insurance provider to report the damage. This is an essential first step to activate your flood insurance claim and set in motion the recovery process required to rebuild and repair.

Ensure you carefully document all damage by taking photos or videos before initiating any cleanup efforts. Providing your insurance company with ample visual evidence can streamline the claims process, ensuring you have a strong foundation for your compensation request.

Documenting Damage and Filing Your Claim

Begin your claims process by compiling a comprehensive inventory of the damages. Document every affected area and item in your home with photographs or video footage, paying particular attention to high-value items that can significantly impact your claim’s outcome. After a flood

After documenting the damage, promptly reach out to your insurance agent to file the claim. Provide detailed evidence and any supplementary documentation required to ensure an accurate assessment of your losses, as this forms the basis of your flood insurance claim and the subsequent recovery of your financial losses.

Receiving Compensation and Rebuilding

Once you file your claim and the insurance adjuster reviews the damage, the process of receiving compensation begins: your insurer will provide a sum to cover the rehabilitation of your premises. It is pivotal to review the insurer’s assessment and compare it with your own documentation to ensure all damages are accounted for and the settlement reflects the true repair costs.

|

Step in Claims Process |

Task |

Expected Outcome |

|---|---|---|

|

Initial Claim Filing |

Contact insurer and present evidence of damage |

Claim is registered and processed by insurance company |

|

Adjuster’s Assessment |

Insurance adjuster evaluates the extent of the damage |

Determination of compensation amount by insurer |

|

Compensation Review |

Analyze the proposed settlement from the insurer |

Agreement on the final amount for rebuilding |

In the reconstruction phase, it’s advisable to oversee the repairs or renovations, aligning them with the stipulations of your flood insurance agreement: this ensures the work proceeds within the financial parameters set by your compensation. Stay engaged with your contractor and insurance agency throughout this period to solve any discrepancies rapidly and to solidify your trajectory back to pre-flood normality.

Frequently Asked Questions

Why is flood insurance necessary in Savannah, GA?

In Savannah, GA, a coastal city vulnerable to hurricanes and storm surges, flood insurance safeguards your home and finances against unpredictable, costly flood damage.

What are the average costs of flood insurance in Savannah?

In Savannah, GA, average flood insurance premiums range from $500 to $700 annually, but property specifics can cause significant deviations from this range.

Which factors can affect my flood insurance rates in Savannah?

Your flood insurance rates in Savannah can vary based on your property‘s elevation, the flood zone it’s in, your home’s value, and the deductible and coverage limits you choose.

How do I compare different flood insurance providers in Savannah?

Research local Savannah rates, review coverage details, consult with independent agents, and check customer satisfaction scores to effectively compare different flood insurance providers.

What steps should I take to file a flood insurance claim in Savannah?

Contact your insurer promptly, report property damage, document losses with photos/videos, fill out claim paperwork, and work with an adjuster.

Conclusion

Understanding flood insurance costs in Savannah, GA is crucial for homeowners looking to protect their property in an area prone to water-related disasters. Knowing the factors that influence premiums, including flood zones, property value, and building materials, allows residents to make informed decisions about their coverage.

Comparing the National Flood Insurance Program with private insurers enables homeowners to find the best rates and coverage limits for their unique needs.

Ultimately, gaining insights into these costs equips Savannah homeowners to secure their homes and financial well-being against the unpredictability of floods.

Information contained on this page is provided by an independent third-party content provider. This website make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact editor @producerpress.com

.png?width=1280&height=720&name=NEW%20Thumbnail%20(19).png)