Soulard Flood Insurance Showdown: NFIP or Private in 2025?

Wondering whether to choose NFIP or private flood insurance for your Soulard home? And how do pricing, basement coverage, and contents protection really compare in 2025?

This article breaks down exactly how both options work, what drives the cost differences, and which one may be the better fit depending on your home’s location, features, and value.

You’ll discover:

-

How coverage limits and exclusions differ

-

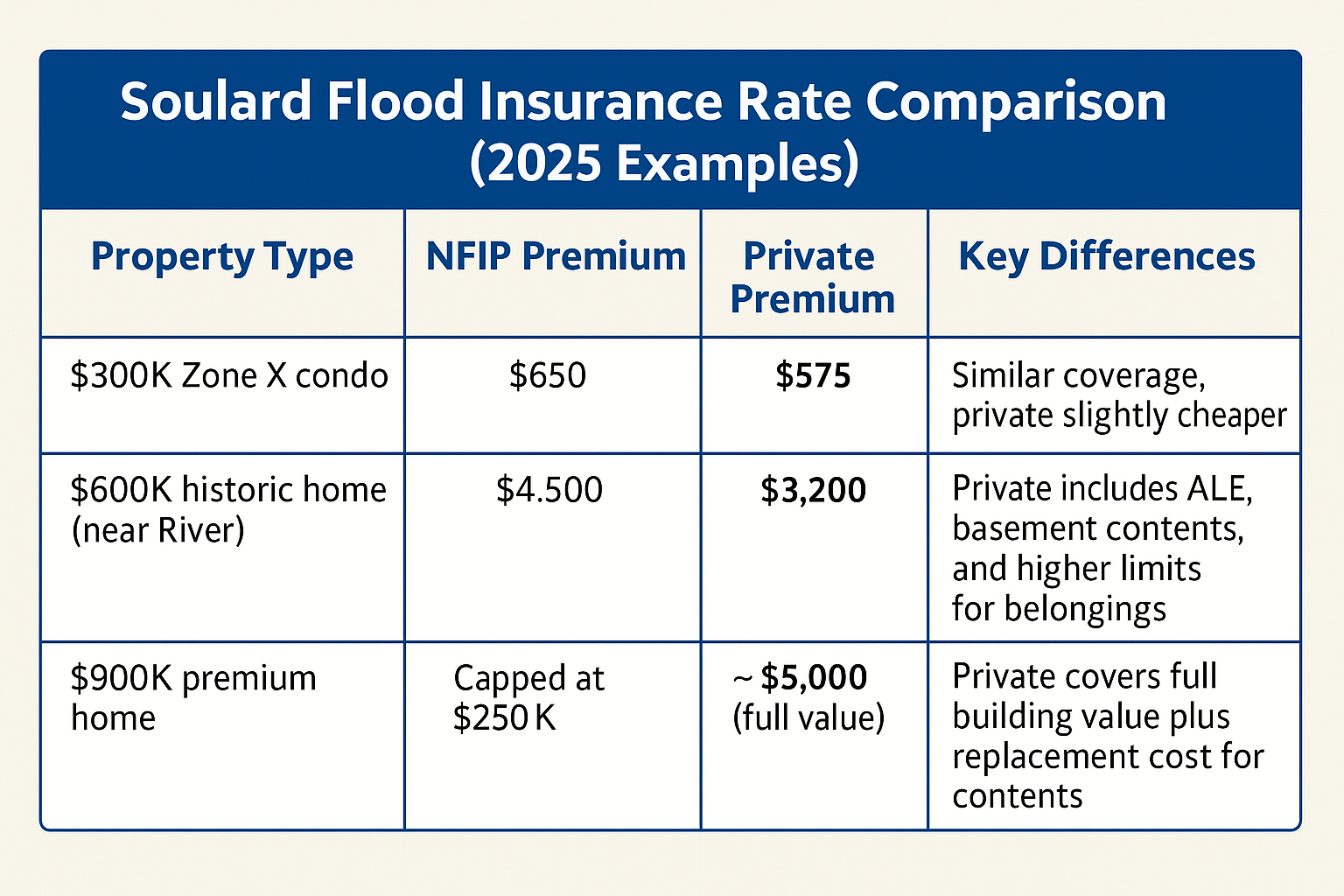

Real Soulard premium comparisons

-

When NFIP still makes sense

-

What private flood insurance can offer that NFIP can’t

How Risk Rating 2.0 Changed the Game

Under FEMA’s Risk Rating 2.0 and with most private insurers, flood zones no longer set your price. Instead, premiums are based on:

-

Distance to water

-

Elevation

-

Foundation type

-

Replacement cost

-

Claims history

-

And more

Flood zones still matter for lender requirements, but not for pricing.

NFIP Flood Insurance (FEMA) in Soulard

Coverage Snapshot

-

Building limit: $250,000

-

Contents limit: $100,000

-

Contents valuation: Actual Cash Value (depreciated)

-

Basement: Limited (usually mechanicals only)

-

Additional Living Expenses (ALE): Not included

-

Waiting period: 30 days (unless tied to a loan or map change)

When NFIP Can Make Sense

-

Lower-value homes

-

Addresses where private carriers are not competitive or available

-

Properties with unique risk profiles that rate better under FEMA’s model

Private Flood Insurance in Soulard

Coverage Snapshot

-

Building coverage: Often up to $1M or more

-

Contents coverage: Higher limits available

-

Contents valuation: Many offer replacement cost, not depreciated value

-

Basement: Often includes finished basements and contents

-

ALE: Commonly included to cover hotel or rental during repairs

-

Waiting period: Often 7 to 14 days, sometimes as fast as 1 to 3 days

-

Pricing: Frequently 25 to 40 percent less than NFIP in Soulard

One private quote does not represent the whole market. Even two policies underwritten by Lloyd’s of London can price differently due to separate rating models and contracts.Pros and Cons at a Glance

NFIP Pros

-

Federally backed and guaranteed

-

Accepted by all lenders

-

Coverage always available, even post-disaster

NFIP Cons

-

Coverage capped at $250K building and $100K contents

-

Contents paid at depreciated value

-

Limited basement protection

-

No ALE

-

Longer 30-day waiting period

Private Pros

-

Higher coverage limits

-

Replacement cost for contents

-

Often includes basement contents

-

ALE usually included

-

Faster policy binding

-

Often lower premiums

Private Cons

-

Coverage terms vary by carrier

-

Some carriers may pause writing new business after large disasters

-

A few lenders are less familiar with private policies, though most accept them

FAQs: NFIP vs Private in Soulard

Is NFIP always more expensive than private?

Not always. Some Soulard homes rate better with NFIP. You need a side-by-side comparison to know for sure.

Does NFIP cover finished basements or contents?

No. NFIP typically covers only essential equipment like furnaces or water heaters. Private flood insurance often includes finished basements and contents, depending on the policy.

Do private policies include Additional Living Expenses (ALE)?

Yes, many do. ALE pays for hotel or rental costs if you can’t live in your home due to a covered flood—something NFIP excludes.

Can I get replacement cost coverage for contents?

Yes. Unlike NFIP’s depreciated payouts, many private carriers offer replacement cost for personal belongings.

Do lenders accept private flood insurance?

Yes, as long as it meets federal guidelines. Most Soulard lenders accept qualified private coverage.

Want to See Your Best Option?

Choosing the right flood policy for your Soulard home could mean saving thousands, gaining basement coverage, or protecting your lifestyle with ALE.

We compare NFIP and multiple private carriers, including several Lloyd’s contracts, to help you:

-

Lower premiums

-

Get replacement cost on contents

-

Cover finished basements

-

Include ALE

-

Match your home’s true value

Information contained on this page is provided by an independent third-party content provider. This website make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact editor @producerpress.com