End of Premium Tax Credits Could Hit Hospitals Financially

Enrollment in the Affordable Care Act (ACA) Marketplace has doubled since the introduction of enhanced premium tax credits in 2021, providing health insurance coverage for more than 24 million Americans.

The credits increased the amount of compensation for eligible ACA Marketplace enrollees and made those with incomes about 400% of the federal poverty guidelines eligible for tax credits, saving enrollees an average of $705 annually and making coverage more affordable. Now, the tax credits are set to expire at the end of 2025.

The expiration of the enhanced premium tax credits is said to cause health insurance costs to skyrocket, resulting in a 114% increase from 2025 to 2026 and more than doubling premiums for those receiving the credits, according to the KFF analysis.

Insurers are also proposing rate increases, citing the expiration of enhanced premium tax credits as a significant reason for raising rates by a median of 18%, and rising health insurance premiums won’t just affect patients.

“Healthcare is one of the biggest businesses in the US,” said Leighton Ku, PhD, MPH, director for the Center for Health Policy Research at George Washington University, Washington, DC. “It’s not just the patients who are getting the ACA tax credits who lose out; healthcare providers, hospitals, [and] pharmacies lose out too. They may have to restrict services, and some may have to shut down, so there are broader repercussions.”

About Medscape Data

Medscape continually surveys physicians and other medical professionals about key practice challenges and current issues, creating high-impact analyses. For example, the Medscape Cost Oversight at Medical Providers Report 2025 found that:

- About 60% of providers reported that they view cost reductions on patient care negatively.

- About 69% of providers reported that they view cost reductions on staff relations negatively.

- About 54% of employers don’t consult with physicians about cost reduction efforts.

- About 38% of providers reported that government policies have a very strong influence on cost reductions.

Bracing for Impact

The expiration of enhanced premium tax credits may leave an estimated 4 million people uninsured, and millions of other insured individuals and families will see their premiums increase. In addition, new legislation and marketplace regulation will create new, additional barriers to ACA enrollment that will likely cause an additional 3 million people to lose marketplace coverage.

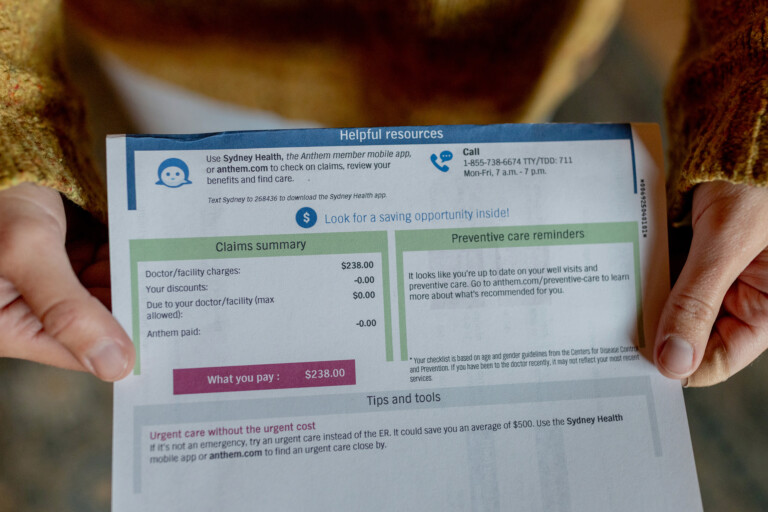

Worse, without coverage, patients are likely to delay or skip care, which could result in the need for more intensive treatments or emergency care in the emergency department or other high-cost health settings. A large uninsured population will also result in steep declines in healthcare spending.

The Urban Institute projects that the enhanced tax credit expiration could trigger healthcare spending declines of more than $32 billion, including $14.2 billion on hospital services, $5.1 billion on office-based healthcare professional spending, $6.9 billion on healthcare services, and $5.8 billion on prescription drugs. The impacts would be most pronounced in Southern states and rural areas that are more reliant on the health insurance marketplace, Ku said.

The number of uninsured individuals also increases uncompensated costs. Hospitals are responsible for the largest share of these costs, but community providers and clinics are affected, too. The burden of unpaid care if the enhanced premium tax credits expire could top $6.3 billion.

“Those folks will still show up at the emergency room and receive care, as the hospitals are obligated to provide,” said Robert Andrews, CEO of Health Transformation Alliance and former member of the US House of Representatives, where he was an original author of the ACA. “It’s going to put significant downward pressure on the margins of healthcare providers.”

Preparing for What’s Next

The expiration of tax credits coupled with rising healthcare costs, narrower networks, and higher deductibles will lead to ripple effects in patient volume and reimbursement, forcing hospitals and clinics to cut costs.

“Certain entities like doctors’ offices or hospitals and drugstores could say, ‘If you can’t pay and you don’t have insurance, we’re not going to serve you,’” Ku said. “That’s not true for emergency rooms…and they are acknowledging that they might have to lose insurance revenue and at the same time increase the amount that they spend on uncompensated care.”

Job losses are also inevitable. The Commonwealth Fund estimates that almost 340,000 jobs will be cut if the tax credits expire and healthcare providers reduce their workforces, and those losses will trickle down to adjacent industries such as pharma companies and medical suppliers, according to Ku.

“When there are fewer people taking care of a problem, the problem usually gets worse,” said Andrews. “The possibility of sitting in the waiting room for 6 hours instead of 4 or the prospect of being seen by the doctor in 3 hours instead of 1 will happen.”

Expiration of the premium tax credits would place hospitals and health systems under considerable financial stress, resulting in uncompensated care and more bad debt and making it harder to maintain services. Andrews also warns of an acceleration of consolidation that will be most prevalent in rural America.

Some states are exploring their own fixes. Colorado, Washington, and Nevada have “public option” plans that have built-in cost containment measures that will keep healthcare premiums low even if Congress fails to extend the enhanced premium tax credits.

Unless the enhanced premium tax credits are temporarily or permanently extended, hospitals will need to find ways to pass along their costs. Andrews notes that Medicare has fixed reimbursement rates, making it impossible to shift costs to programs like Medicare Advantage.

“That leaves commercial payers, and that means employers,” he added. “So, to the extent that healthcare systems are going to be able to shift those costs on to employers and employees, that’s what they’re going to try to do.”

Technologies like artificial intelligence could boost efficiencies to offset longer wait times and job losses, but those tools require upfront investments that will be difficult for hospitals to make when there are more uninsured patients, fewer services rendered, higher rates of uncompensated care, and lower revenues.

Ku has a stark message for health systems, hospitals, and healthcare providers: If the premium tax credits are allowed to expire at the end of 2025, the impacts will be profound.

Jodi Helmer is a freelance journalist who writes about health and wellness for Fortune, AARP, WebMD, Fitbit, and GE HealthCare.