Top California insurance News

-

Geico Sues Michigan Woman For Unexpected Reason After She Files Claim

Lanier/Getty Images Imagine you get hungry and decide to hop into your car to go grab a bite to eat. Along the way, however, you’re T-boned by another vehicle. Naturally, you need to file a claim with your insurance provider,…

-

Ripple and UC Berkeley Introduce UDAX Program to Grow XRP Ledger Ecosystem

Key Takeaways: The first batch consisted of nine startups that specialized in such areas as tokenized capital markets, decentralized insurance, and the creator economy. The teams that participated indicated an average of 67 percent increase in product maturity and 92 percent growth in confidence in fundraising after six weeks of pilot. Ripple recently reported that

-

Affordable Care Act enrollments are down amid increased premiums

Affordable Care Act signups are down in most states as the open enrollment period ends on Thursday, while federal lawmakers continued working on subsidies extension bills on Tuesday. File Photo by Bonnie Cash/UPI | License Photo Jan. 13 (UPI) — The end of temporary subsidies for Affordable Care Act health insurance policies is raising rates

-

Medicaid Health Plans Step Up Outreach Efforts Ahead of GOP Changes

ORANGE, Calif. — Carmen Basu, bundled in a red jacket and woolly scarf, stood outside the headquarters of her local health plan one morning after picking up free groceries. She had brought her husband, teenage son, and 79-year-old mother-in-law to help. They grabbed canned food, fruit and vegetables, and a grocery store gift card. And

-

Worried About Health Insurance Costs? There May Be Cheaper Options — But With Trade-Offs

For the millions of Americans who buy Affordable Care Act insurance, there’s still time left to enroll for 2026. But premium increases and the expiration of enhanced tax subsidies have led to larger-than-expected costs. Concerned shoppers, wondering if there’s anything they can do, are consulting insurance brokers or talking to representatives at ACA marketplace call

-

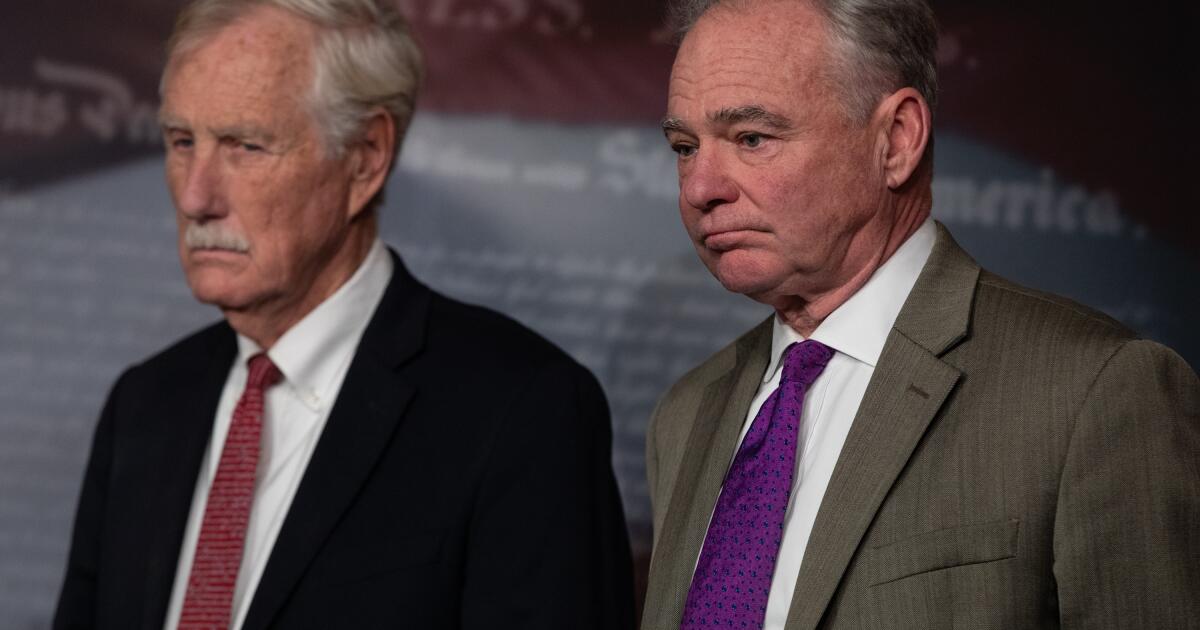

Republicans defy Johnson to force House vote on extending health insurance subsidies

WASHINGTON — Four House Republicans broke with party leadership on Wednesday to join Democrats in overriding the GOP majority and forcing a vote on extending healthcare tax credits — a defection that underscores the party’s growing vulnerability on economic issues ahead of next year’s midterm elections. The healthcare tax credits, which were central to the fight that

-

Headlines for December 12, 2025

Hi there, Democracy Now!’s independent journalism is more vital than ever. We continue to spotlight the grassroots movements working to keep democracy alive. No time has been more crucial to amplify the voices that other outlets ignore. Please donate today, so we can keep delivering fact-based, fearless reporting. Every dollar makes a difference . Thank

-

Sticker Shock: Obamacare Customers Confront Premium Spikes as Congress Dithers

We’ve been here before: congressional Democrats and Republicans sparring over the future of the Affordable Care Act. But this time there’s an extra complication. Though it’s the middle of open enrollment, lawmakers are still debating whether to extend the subsidies that have given consumers extra help paying their health insurance premiums in recent years. The

-

Swing district Republicans brace for fallout over health care

ALLENTOWN, Pa. (AP) — Republicans in key battleground U.S. House districts are working to contain the political fallout that may come when thousands of their constituents face higher bills for health insurance coverage obtained through the Affordable Care Act. For a critical sliver of the Republican majority, the impending expiration of what are called enhanced

-

New poll shows ACA enrollees are struggling with health costs

WASHINGTON (AP) — Fifty-two-year-old Dinam Bigny sank into debt and had to get a roommate this year, in part because of health insurance premiums that cost him nearly $900 per month. Next year, those monthly fees will rise by $200 — a significant enough increase that the program manager in Aldie, Virginia, has resigned himself

-

House set to vote on deal to end shutdown amid Democratic splits – US politics live

House Democrats release emails that allege Trump knew about Epstein’s crimes In a new batch of emails released by Democrats on the House oversight committee, Jeffrey Epstein wrote that Donald Trump knew about the late financier and sex-offender’s crimes. In the three emails released, Epstein apparently told his accomplice Ghislaine Maxwell that Trump “spent hours”

-

Chabria: Democrats crumble like cookies. Is this really the best they can do?

Democrats just crumbled like soft-bake cookies. The so-called resistance party has given up the shutdown fight, ensuring that millions of Americans will face Republican-created skyrocketing healthcare costs, and millions more will bury any hope that the minority party will find the substance and leadership to run a viable defense against President Trump. Sunday night, eight

-

Headlines for November 7, 2025

Headlines November 07, 2025 Watch Headlines Sudan’s Rapid Support Forces Agree to Humanitarian Ceasefire Nov 07, 2025 In Sudan, the paramilitary Rapid Support Forces said Thursday they’ve agreed to a U.S.-backed ceasefire proposal to end more than two years of a devastating war with the Sudanese military. The truce was brokered by a U.S.-led group