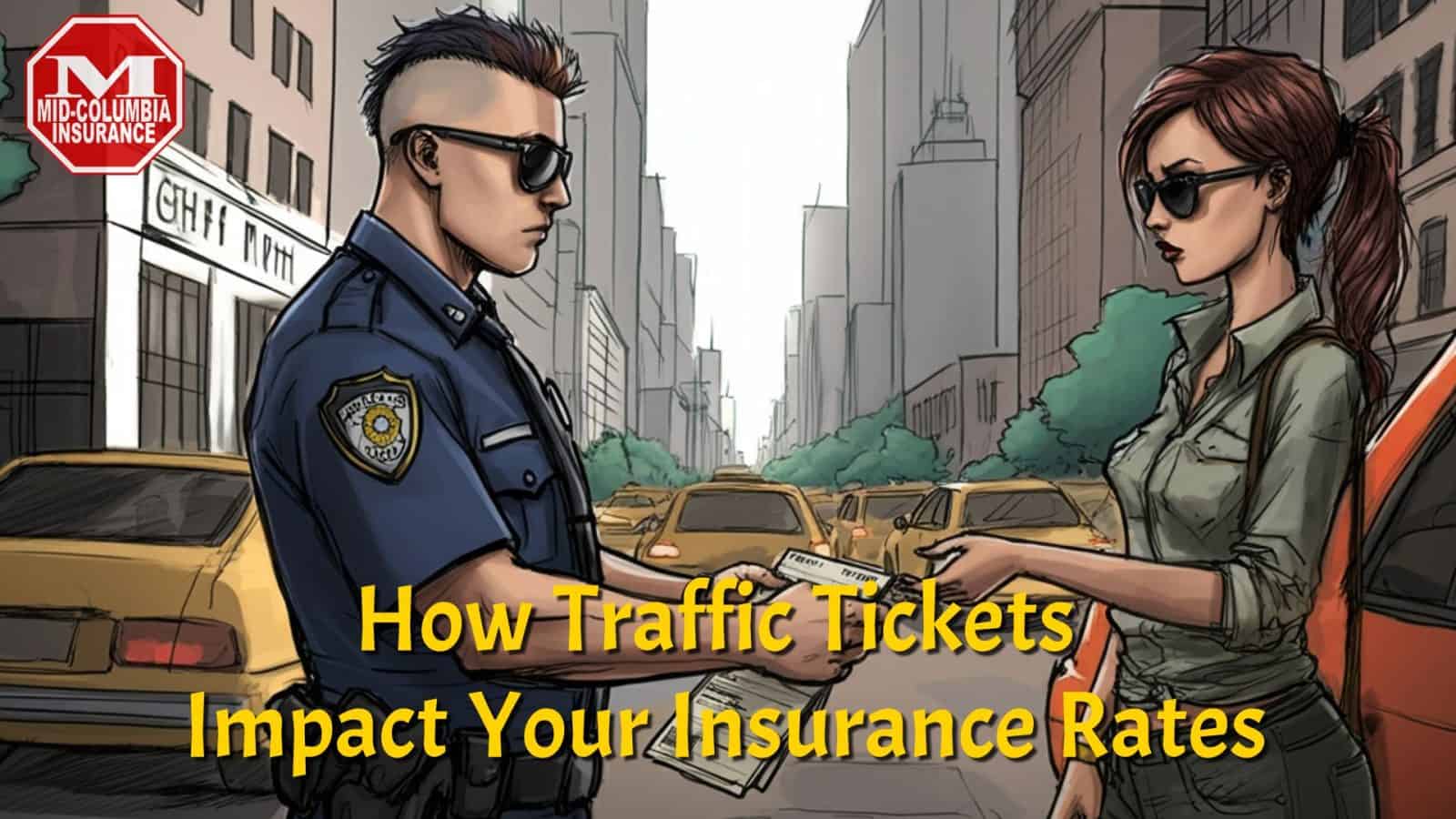

Traffic Tickets Guide: Real Costs & Insurance Impact

Traffic violations in Washington state can significantly impact your driving record and Insurance

” href=”https://midcolumbiainsurance.com/glossary/insurance” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>insurance rates, but Mid-Columbia Insurance is here to help you navigate these challenges. With over 25 years of experience serving Washington drivers, our team understands how to find the best insurance solutions even after receiving a citation.

The Reality of Traffic Citations in Washington State

Law enforcement officers in Washington state issue an astounding 2,300 traffic citations every day. This high frequency of tickets affects drivers across the state, from Seattle, WA

” href=”https://midcolumbiainsurance.com/seattle-wa” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>Seattle’s busy highways to Spokane, WA

” href=”https://midcolumbiainsurance.com/spokane-wa” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>Spokane’s city streets. Unlike other states, Washington operates without a point system, instead tracking violations directly through the Department of Licensing.

“Many drivers don’t realize that a single traffic ticket can affect their insurance rates for years,” explains Gary Paulson

” href=”https://midcolumbiainsurance.com/gary-paulson” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>Gary Paulson, owner of Mid-Columbia Insurance. “That’s why we work with multiple carriers like Progressive Insurance

” href=”https://midcolumbiainsurance.com/progressive-insurance” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>Progressive, The General Insurance

” href=”https://midcolumbiainsurance.com/the-general-insurance” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>The General, Dairyland Insurance

” href=”https://midcolumbiainsurance.com/dairyland-insurance” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>Dairyland, and National General Insurance

” href=”https://midcolumbiainsurance.com/national-general-insurance” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>National General to find the most affordable options for our clients, regardless of their driving history.”

Understanding Insurance Premium Impacts

A single speeding violation in Washington typically results in a $22 monthly insurance increase, lasting for three years. Let’s break down the total financial impact:

| Time Period | Additional Cost |

|---|---|

| Monthly | $22 |

| Yearly | $264 |

| Total (3 years) | $792 |

This increase doesn’t include the actual ticket cost, court fees, or other associated expenses. Our partnerships with carriers like Dairyland and Bristol West Insurance

” href=”https://midcolumbiainsurance.com/bristol-west-auto-insurance” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>Bristol West help us find competitive rates even for drivers with recent tickets.

Washington’s Unique Traffic Violation System

The state courts in Washington handle traffic violations differently than many other states:

- No point system tracking

- Five-year violation retention period

- Recognition of out-of-state violations

- Direct impact on license status

- Multiple resolution options

Citation Resolution Options and Insurance Implications

When receiving a traffic citation, Washington drivers have three main options:

- Direct Payment • Admits guilt • Immediately affects insurance • Appears on driving record • Simplest but potentially costliest long-term

- Citation Mitigation • Partial admission of responsibility • Possible reduced penalties • May include traffic school • Could minimize insurance impact

- Contest the Citation • Challenges ticket validity • Requires evidence or testimony • 25% of tickets contain errors • Could prevent insurance increases

Record Management and Long-term Effects

The Washington Department of Licensing maintains violation records for five years. This means:

- Insurance carriers can view violations for full duration

- Out-of-state tickets appear on Washington records

- Multiple violations Risk

Risk is the possibility of loss, injury, or other adverse consequences due to uncertainty. In finance and insurance, risk plays a crucial role in decision-making and the pricing of products and services.Term details

” href=”https://midcolumbiainsurance.com/glossary/risk” data-mobile-support=”0″ data-gt-translate-attributes=”[{“attribute”:”data-cmtooltip”, “format”:”html”}]” tabindex=”0″ role=”link”>risk license suspension

- Insurance rates may be affected throughout period

- Careful driving can prevent additional increases

Risk Mitigation and Prevention Strategies

Traffic school providers and defensive driving courses can help reduce the impact of citations. Consider these proactive steps:

- Complete approved defensive driving courses

- Maintain clean driving record post-violation

- Choose appropriate insurance coverage

- Work with experienced insurance agents

- Keep detailed records of all citations

Professional Support and Insurance Solutions

The insurance representatives at Mid-Columbia Insurance understand Washington’s traffic laws and insurance regulations. Our approach includes:

- Thorough Assessment • Review current violations • Analyze coverage needs • Evaluate multiple carriers • Consider future implications

- Customized Solutions • Compare available options • Match with appropriate carriers • Maximize available discounts • Plan for future improvements

- Ongoing Support • Regular policy reviews • Claims assistance • Coverage adjustments • Continuous monitoring

Taking Action After a Citation

When dealing with traffic violations, timing and proper action are crucial. Consider these immediate steps:

- Contact experienced insurance agents

- Review current coverage details

- Explore resolution options

- Consider legal consultation

Information contained on this page is provided by an independent third-party content provider. This website make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact editor @producerpress.com

![stay-legal-when-riding-your-motorcycle-in-washington-[infographic]](https://producerpress.com/wp-content/uploads/2025/01/375397-stay-legal-when-riding-your-motorcycle-in-washington-infographic.jpg)