Skip to content

Reading Time: 5 minutes Reading Time: 1 minute Reading Time: 5 minutes

Alabama Insurance

Reading Time: 5 minutes

Alaska Insurance

Reading Time: 7 minutes

Arizona Insurance

Reading Time: 10 minutes

California Insurance

Reading Time: 7 minutes

Colorado Insurance

Reading Time: 5 minutes

Connecticut Insurance

Reading Time: 5 minutes

Delaware Insurance

Reading Time: 28 minutes

Florida Insurance

Reading Time: 4 minutes

Georgia Insurance

Reading Time: 3 minutes

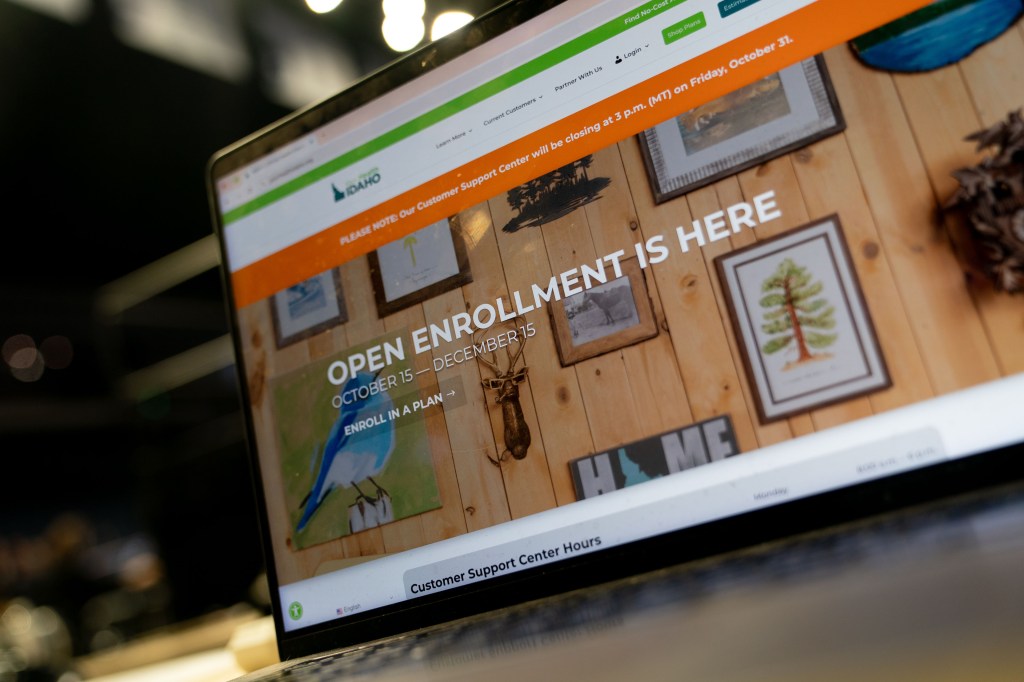

Idaho Insurance

Reading Time: 4 minutes

Illinois Insurance

Reading Time: 22 minutes

Indiana Insurance

Reading Time: 4 minutes

Kansas Insurance

Reading Time: 8 minutes

Kentucky Insurance

Reading Time: 5 minutes

Louisiana Insurance

Reading Time: 4 minutes

Maine Insurance

Reading Time: 5 minutes

Maryland Insurance

Reading Time: 6 minutes

Massachusetts Insurance

Reading Time: 7 minutes

Michigan Insurance

Reading Time: 4 minutes

Mississippi Insurance

Reading Time: 4 minutes

Missouri Insurance

Reading Time: 6 minutes

New Hampshire Insurance

Reading Time: 7 minutes

New Jersey Insurance

Reading Time: 4 minutes

New Mexico Insurance

Reading Time: 5 minutes

New York Insurance

Reading Time: 3 minutes

North Carolina Insurance

Reading Time: 6 minutes

Ohio Insurance

•

Reading Time: 4 minutes

Oregon Insurance

Reading Time: 6 minutes

Pennsylvania Insurance

Reading Time: 4 minutes

Texas Insurance

Reading Time: 6 minutes

Utah Insurance

Reading Time: 2 minutes

Vermont Insurance

Reading Time: 4 minutes

Washington Insurance

Reading Time: 1 minute

Wisconsin Insurance

Reading Time: 6 minutes

Warning! This link is a trap for bad bots! Do not follow this link or you're IP adress will be banned from the site!

![best-whole-life-insurance-in-washington-([current-date-format=y])](https://producerpress.com/wp-content/uploads/2025/10/465790-best-whole-life-insurance-in-washington-current-date-formaty.jpg)